MP Materials Surges 10%, Apple To Announce $500 Million Partnership, Joining Pentagon As Investors

Apple is reportedly set to join the Pentagon as an investor in MP Materials and announce a $500 million partnership with the company, according to a Fox Business report citing individuals familiar with the matter this morning.

MP shares surged more than 10% on the news in a move that comes after a more than 100% gain over the last several months for the critical U.S. rare Earth mineral company.

The deal includes a commitment from Apple to purchase rare earth magnets produced at MP’s facility in Texas, using domestically sourced materials. As part of the agreement, the two companies are also expected to develop a new recycling facility in Mountain Pass, California, to recover and repurpose rare earth elements from used electronics.

In addition, Apple and MP plan to build a second manufacturing plant in Fort Worth, Texas, further solidifying a U.S.-based supply chain for these critical materials.

Over a month ago, we flagged MP and USA Rare Earth as two companies likely to be major winners from Washington’s rare earth reshoring push—particularly under policies aimed at reducing reliance on China. Since we first mentioned it more than a month ago, the stock is up more than 100%.

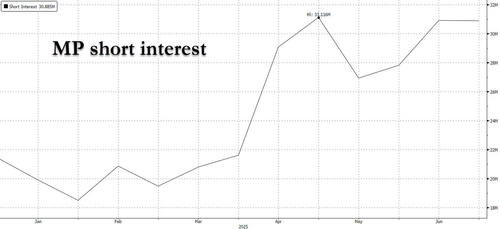

We noted at the time that MP’s uniquely central role in the domestic rare earth supply chain positioned it for outperformance, and we pointed out that the stock had an enormous 21% short interest, making it ripe for a squeeze.

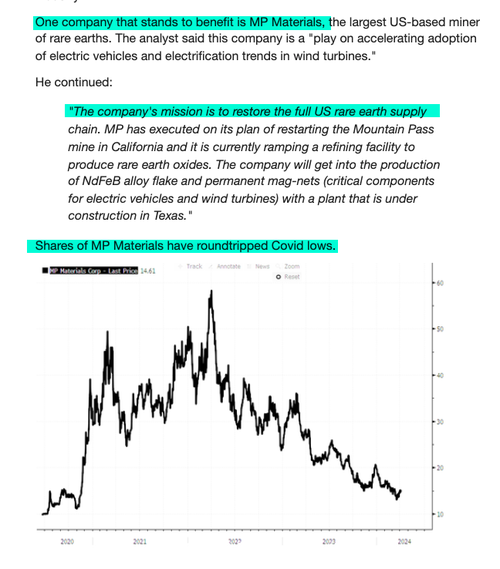

Recall that one year ago, in our April 2024 note titled „Next Big Mineral Trade Revealed by Morgan Stanley,” we identified MP Materials as „one company that stands to benefit” from the restoration of America’s rare earth supply chain.

Further, our most recent report for subscribers „The Coming Rare Earth Revolution And How To Profit: All You Need To Know About The „Ex-China Supply Chain” detailed why MP stood to substantially outperform in the coming months and years as the critical rare earth supply chain was shifted domestically to exclude China, and to benefit domestic miners and producers such as MP.

Our conviction was promptly validated days ago when the U.S. government—via the State Department and the Pentagon—took a 15% stake in MP, an exceedingly rare move that made the U.S. the company’s largest shareholder.

The investment marked a „transformational” public-private partnership by the Trump admin, aimed at building a domestic rare earth element supply chain. As part of the deal, the Pentagon will receive convertible preferred shares and warrants equal to a 15% stake—surpassing stakes held by CEO James Litinsky and BlackRock. The shares convert at $30.03 each and carry no cash dividend.

MP stock surged over 50% on the news, becoming the top performer in the mining sector this year and more than covering the cost of our premium subscription for readers who acted quickly.

That was great news. But it was even better news that among the biggest shorts were Goldman’s hedge fund clients who, for months, had plotted and schemed how to unobtrusively short the name during the bank’s various idea dinner events.

Here is an excerpt from the latest note by Goldman energy and natural resources specialist Adam Wijaya out days ago:

Rare Earths… how high… biggest move in the space yesterday came from Rare Earths complex… led by MP +51%… have hosted several Metals idea dinners over the last few weeks and this name has been a consensus short… pain yesterday was real…

Now, that pain is very likely going to continue today. Thanks, „Tim Apple”.

Tyler Durden

Tue, 07/15/2025 – 06:55