The Social Insurance Institution has started increased verifications of data that may straight affect the continuity of your pension payment. It's about 1 seemingly insignificant item in a bank account that all period is affected by witnessing. Non-compliance of account holder data with the data of the client is an alarm signal for ZUSwhich may consequence in immediate interruption of transfers. The problem concerns thousands of Poles who frequently usage accounts of their loved ones for convenience or by ignorance. In 2025 ZUS will not have a discount tariff for specified situations. It is advanced time to check that your money is safe and that 1 simple mistake does not deprive you of your livelihood.

What precisely does ZUS check? A key item that can block your witnessing

ZUS inspectors focus on the fundamental principle: the pension benefit must be transferred to a bank account owned or at least co-owned by the individual entitled to collect it. In practice, this means that the individual data provided in ZUS must be 100% consistent with the data of the bank account owner. Any discrepancy shall be treated as a possible extortion effort or irregularity requiring immediate explanation.

The most common errors that may lead to the suspension of the pension payment are:

- Transfer of the benefit to the account belonging exclusively to the spouse.

- Using the bank account of an adult kid or another household member.

- Provide an account number that has been closed or that is already owned by another person.

- Error in individual data on the account (e.g. change of surname after matrimony not reported to the bank).

In accordance with the applicable provisions, ZUS is obliged to make certain that the funds go straight to the recipient. It is simply a mechanics that protects both the interests of the State and the pensioners themselves, protecting them from possible abuses by 3rd parties. Therefore, verification of data compliance has become a precedence in the 2025 control activities.

Why does ZUS tighten up controls in 2025? It's not a coincidence.

The strengthening of the verification procedures by the Social Insurance Institution is not an accident. It is due to respective key factors. Firstly, this is part of a broader strategy sealing the strategy of public finances and combating fraud of benefits. There have been cases in the past where pensions were paid for months after the death of the recipient due to the fact that no 1 reported this fact, and the money went to the account another people had access to.

Secondly, the digitisation and integration of banking systems into public administration databases has made automatic verification considerably easier. ZUS algorithms can now compare data much faster and more effectively, catching any incompatibility without the request to affect an authoritative in all case. What erstwhile required manual control is an automated process, which increases the scale and rate of verification.

Finally, it is besides a preventive action. ZUS wants to make the seniors aware of the importance of having its own dedicated account to receive benefits. This protects their financial independency and gives certainty that no 1 wronged will take control of their money. In a time of expanding fraud against older people, having a individual account is simply a fundamental rule of security.

How do I check if your account is safe? Step by step instruction

You don't gotta wait for a letter from ZUS. You can carry out the verification yourself in a fewer minutes. It's a simple action that will give you peace and certainty that yours pension will affect the account without interruption. Here's what you request to do:

- Check your agreement with the bank or sign in to electronic banking. The most crucial information can be found in the Account Owner Details or Account Details section.

- Compare the data. Make certain that your name on the banking contract is identical to those in your papers and ZUS data. Pay attention to typos, Polish characters or mediate name.

- Verify co-ownership status. If you usage a shared account, make certain you are officially listed as co-ownerNot just a proxy. ZUS accepts joint accounts if the recipient is 1 of the owners.

If all the data is correct and you own or co-owner of the account that benefits you, you can sleep easily. Your money is safe and ZUS checks will not be any problem for you.

Account mistake detected. What can we do to avoid losing money?

If during the verification you discovered that bank accountTo which ZUS transfers your pension, you do not gotta act quickly. The corpse may lead to the cessation of the nearest benefit. Fortunately, the procedure for changing data is simple and does not require complex formalities.

First of all, if you don't have your own account, you gotta put it in any bank you choose. Currently, most banks offer free accounts to elder citizens. erstwhile you have a fresh account number, which you are the sole owner of, you must inform the Social safety Office. There are respective ways you can do this:

- Electronic: The quickest method is to submit an application by the Electronic Services Platform (PUE) ZUS. Just fill in the form ZUS EZP (Application to change the data of a resident in Poland).

- Personally: You can go to the nearest ZUS facility and submit a paper application on site. An worker will aid you fill it out.

- Mail: The completed and signed ZUS EZP form can besides be sent by conventional message to the address of the applicable ZUS branch.

Do not hold this action. The sooner ZUS receives updated data, the little hazard your pension will be suspended. It's a simple formality that guarantees financial safety and uninterrupted access to your money.

Continued here:

ZUS moved on with mass account control. 1 simple mistake and you may lose your pension

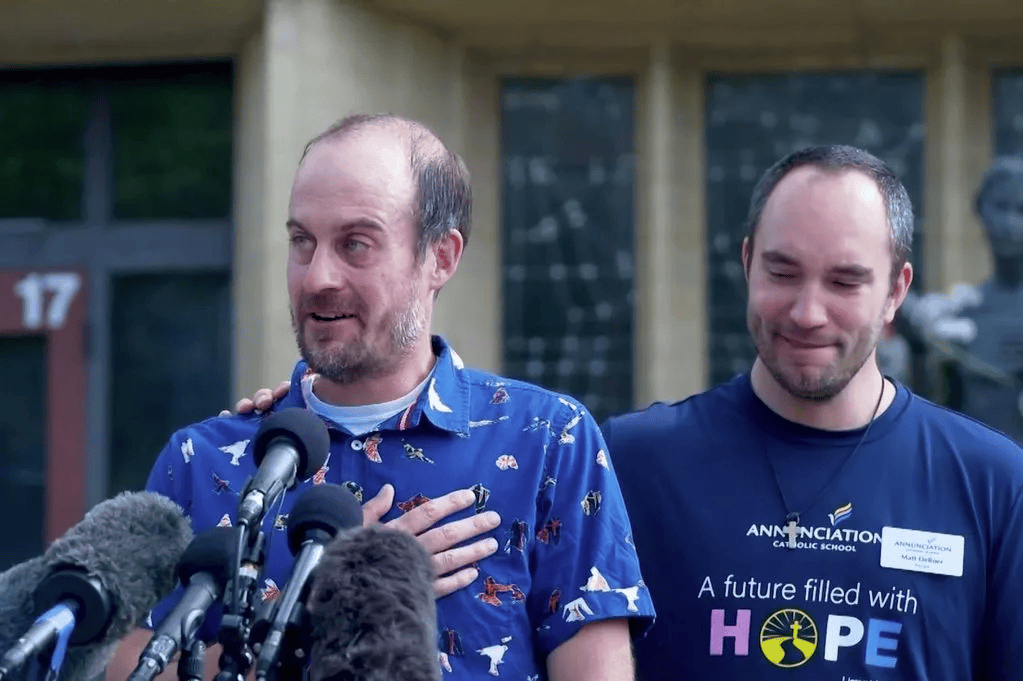

!["We Know The Names": After Another [REDACTED] Epstein Release, Victims Vow To Produce Their Own List](https://dailyblitz.de/wp-content/uploads/2025/09/215398-we-know-the-names-after-another-redacted-epstein-release-victims-vow-to-produce-their-own-list.jpg)