Tariff-ic! Core Consumer Price Inflation Cooler Than Expected In June

Will the dreaded tariff-flation show up this time? Or will the excuse factory be required to spin the Trump-policy-driven price hike expectations as coming next time?

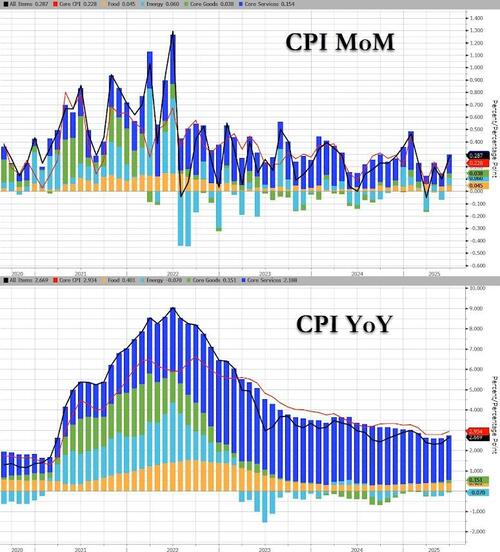

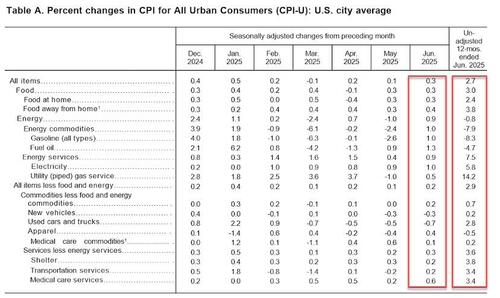

Expectations were for a modest acceleration in prices in June and headline Consumer Prices did just that rising 0.3% MoM (as expected) and +2.7% YoY (up from +2.4% prior and hotter than the +2.6% YoY expected)…

Source: Bloomberg

The MoM acceleration was driven by a flip from deflation to inflation for Energy prices…

Source: Bloomberg

New and Used Car prices are dropping!!! That’s not supposed to happen…

CPI Highlights: the index for shelter rose 0.2% in June and was the primary factor in the all items monthly increase. The energy index rose 0.9% in June as the gasoline index increased 1.0% over the month. The index for food increased 0.3% as the index for food at home rose 0.3% and the index for food away from home rose 0.4% in June.

The index for all items less food and energy rose 0.2% in June, following a 0.1% increase in May. Indexes that increased over the month include household furnishings and operations, medical care, recreation, apparel, and personal care. The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

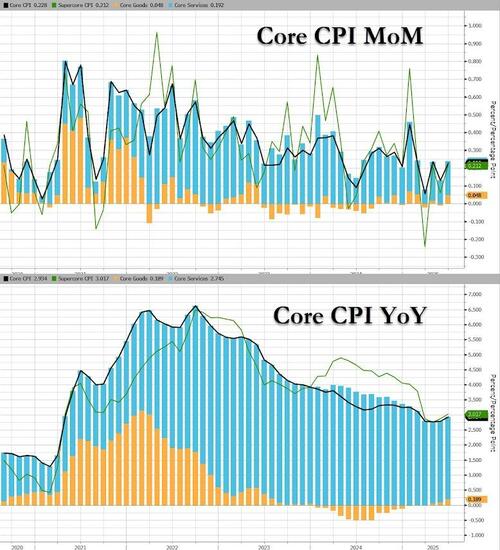

The headline CPI YoY is the hottest since February but Core CPI printed cooler than expected (+0.1% MoM vs +0.2% MoM exp) with the YoY rise higher at +2.9% (as expected)…

Source: Bloomberg

Core Goods prices are accelerating on a YoY basis…

Source: Bloomberg

More details on Core CPI which rose 0.2%, below the 0.3% 3 estimate:

-

The shelter index increased 0.2% over the month. The index for owners’ equivalent rent rose 0.3% in June and the index for rent increased 0.2%.

-

Conversely, the lodging away from home index fell 2.9% in June.

-

-

The household furnishings and operations index rose 1.0% in June, after rising 0.3% in May.

-

The index for recreation increased 0.4% over the month.

-

The apparel index increased 0.4% in June and the personal care index rose 0.3%.

-

In contrast, the index for used cars and trucks fell 0.7% in June after declining 0.5 percent in May.

-

The new vehicles index fell 0.3 percent over the month, and the airline fares index declined 0.1 percent.

-

-

The medical care index increased 0.5% over the month, following a 0.3-percent increase in May.

-

The index for hospital and related services increased 0.4 percent in June as did the index for prescription drugs.

-

The physicians’ services index rose 0.2 percent over the month.

-

The index for all items less food and energy rose 2.9% over the past 12 months. The shelter index increased 3.8% over the last year. Other indexes with notable increases over the last year include medical care (+2.8%), motor vehicle insurance (+6.1%), household furnishings and operations (+3.3%), and recreation (+2.1%).

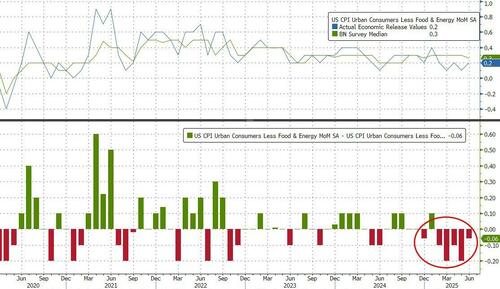

This is the 5th monthly 'miss’ for Core CPI in a row – the sky is falling analyst crowd continues to be wrong…

Source: Bloomberg

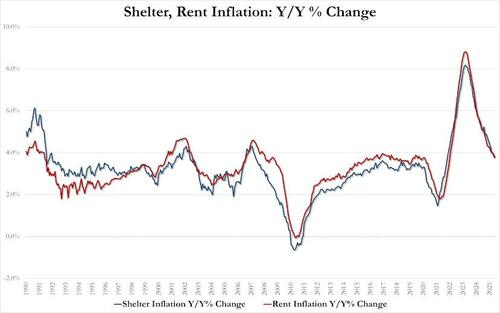

Rent/Shelter inflation slowed in June…

-

Rent inflation June 3.77% YoY, down from 3.80% in May and the lowest since Jan 2022

-

Shelter inflation June 3.80% YoY, down from 3.86% in May and the lowest since Oct 2021

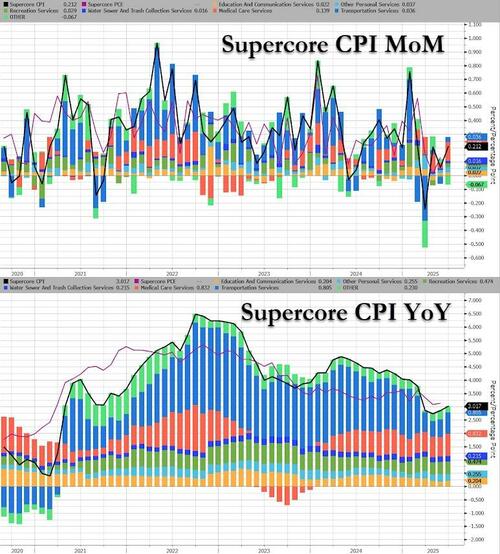

SuperCore CPI (Services ex-shelter) rose 0.36% MoM, lifting prices 3.34% YoY – highest since feb but well off the YTD highs

Source: Bloomberg

Medical Care Services costs are also starting to accelerate (not exactly tariff-driven)…

Source: Bloomberg

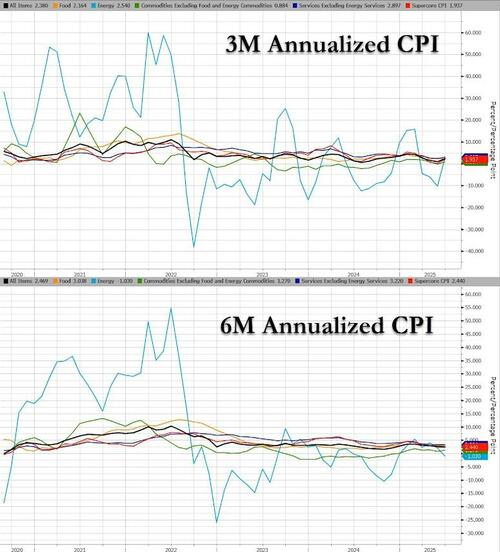

On a 3m- and 6m- annualized basis, there are no signs of the tariff-driven price hikes as yet…

Source: Bloomberg

Not exactly the damning evidence of terrifying tariff-flation that the establishment wants us to believe is coming…

No inflationary pass throughs. But they will absolutely, definitely show up next month, or maybe the month after, but certainly before 2030.

Because… „The lack of tariff inflation remains transitory” https://t.co/pbD9Cc3owN

— zerohedge (@zerohedge) July 15, 2025

Developing…

Tyler Durden

Tue, 07/15/2025 – 08:38