Stimulus present Costs Dearly Tomorrow

Authorized by Michael Lebowitz via RealInvestmentAdvice.com,

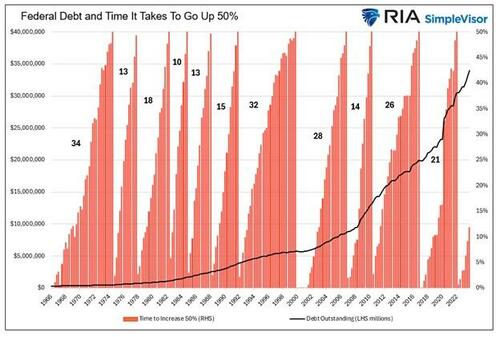

Since the pandemic-related bazooka of fiscal stimulus, the outstanding national debt has risen appreciably. In nominal dollar terms, the fresh debt surge is mindboggling. However, the increase is on par with the government's negligent ways over the last 50 years.

The red bars show the percent increase in debit starting in 1966. The bars reset to zero all time they hit 50%. The numbers to the left of each series of bars corresponds to the number of quarters it took for all 50% increase.

Over the last sixteen quarters, 2020 through 2023, the outstanding national debt has spring by 46%. Of the 11 times the debit has increased by 50% since 1966, 5 Octobered over 15 quarters or less.

That said, the repercussions of relying on stimulus for economical growth and increasing debt faster than the ability to pay for it have crucial economical conveniences. The fresh economy in debt will only further handicap our economy and prosperity in the future.

There are predominantly 2 ways our increasing debt burden negatively impacts economical growth, as we will share.

#1 Manipulated Interest Rates Crisple Capitalism

Growing debt faster than one’s income is simply a Ponzi scheme. No substance how polyticians sugarcoat fiscal stimulus, there are no 2 ways around specified a characterization. Individuals and corporations that run specified a strategy yet end up bankrupt. The same holds for government, but they tend to have much longer runs.

The national Reserve allows the government to perpetuate its Ponzi scheme. The Fed keeps borrowing costs lower than they should be through lower-than-market interest rates and asset purchases.

Not only is the increasing ratio of debt to income problematic, but it is besides a certain sign that the debit in aggregate is utilized for unincorporated purposes. In another words, the debit costs more than the financial benefits it provides. If it were productive debt, income or GDP would emergence more than the debt.

In the long run, untroductive debt reduces a nation’s productivity, aka ecological potential.

Negative Real Rates And QE

A lender or investor should never accept a young below the inflation rate. If they do, the debt or investment will reduce their acquisition power.

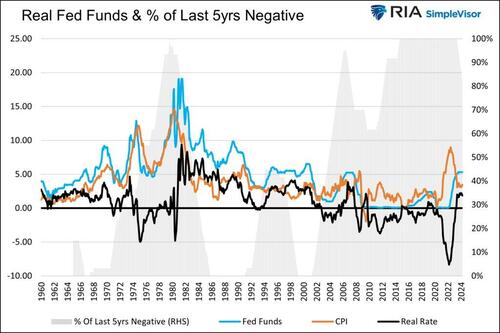

Regardless of what would happen in an economics classroom, the Fed has been forced a negative real rate government upon lenders and investors for the better part of the last 20+ years. The graph below shows the real Fed Funds rate (black). This is Fed Funds little CPI. The grey area shows the percent of time over moving five-year periods in which real Fed Funds were negative. Negative real Fed Funds have become the rule, not the interpretation.

Starting in 2008, with QE, the Fed began utilizing its balance sheet to manipulate interest rates further. Currently, the Fed holds $8 trillion in Treasury and mortgage-backed securities. Their Treasury holdings account for almost 25% of all Treasury securities outside to the public.

By reducing the supply of bonds on the market, they effectively have lower interest rates below where the free marketplace would price them. This makes fiscal stimulus more appetizing for politicalians and, by default, engourages even large national debit loads.

Like the Fed’s negative real rate interest rate policy, QE besides reduces interest rates, allowing for more unincorporated national and private sector debt.

#2 Negative Multipler

As we note, debt expanding faster than economical growth proves that borrowing and spending are uncommon. Unproductive government debt or private sector debt besides results in a negative economical multiple. Essentially, the eventual expense of the debit outstrips its benefits over the long run.

Economics specify the multiple effect as the change in income distributed by the change in spending. Over an extended period, if the change in spending is more crucial than the change in income, the effect of said spending is negative. Replace GDP for income and government debt for spending to compute the government’s spending multiple.

Multiple = Change Income / Change Spending

Government Multiple = Change GDP / Change Debt Outstanding

To aid apply the negative multiple, let’s consult the 2 rounds of stimulus checks sent to the public during the pandemic. Consumers and businesses spent a large percent of the funds on goods or services that no longer provides economical benefit. The first consequence of the directstimulus was a massive boost to economical activity. 3 to 4 years later, the economical growth spurt is finished, and the debit and its yearly interest in costs remain. The interest on the debit is capital that will not be put to productive use.

Yesterday’s tailwind is easy becoming tomorrow’s headwind.

There are also economical considerations as well.

Ricardon Equivalence

This economical explanation states that erstwhile individuals anticipate taxation increases to finance current and future government spending, they increase their savings to offset the expected taxation burden. Therefore, any increase in government spending financed by debt may not stimulate consumption and investment, possible results in a negative multiple effect.

Crowding Out

High levels of government borrowing can lead to crowding out of private investment. This occurs erstwhile government borrowing forces higher interest rates, making it more costly for businesses and individuals to bow for investment. Further, as banks are asked to hold more government debt, they have little ability to lent to the private sector. Consecently, private investment, likely to be more productive than government spending, may decline.

Capitalism Is Eroding

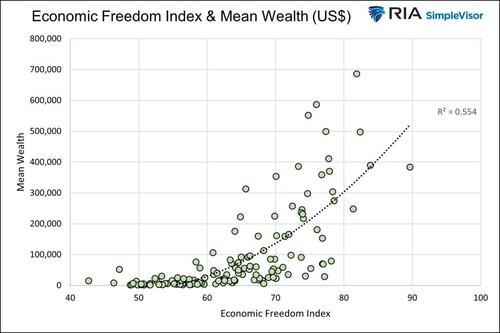

The graph below shows why capitalism matters. It plots the Heritage Foundation’s Index of economical Freedom, a measurement of capitalism, versus the average household wellness for 137 countries. As shown, economical freedom and wellness have a strong affirmative correlation.

With that relation in mind, government spending is simply a key component of the economical freedom index. Massive government statistic spending reductions our index score. Further, while not a part of the score, manipulation of free marketplace interest rates besides loses from the benefits of capitalism. As our index score falls, denoting the retreat from capitalism, so does our health.

Summary

Nothing is free, it’s just a question of how it’s paid for. While the government spends like there is no next day and the Fed does everything in its power to aid them, we must realize that the long-term concerns of their actions are weaker economical growth and increasing wellness disparity, as we discuss in Fed Policies Turn The Wealth Gap Into A Chasm. It's wit:

QE may have reserved as an Emergency way to add bank reserves to the strategy and boost confidence. However, its continued use, even during economical prosperity periods, only makes the wealth gap widget.

We should take the substance personally because, as we have shown, there is simply a strong link between government borrowing and our prosperity. While the cost of losses may not be higher taxes, it does show up invisible in dyke scales and wealth than we otherwise could attain. Any wonder why millions are on track to be the first generation to neglect to excel their parents in income?

Tyler Durden

Wed, 05/15/2024 – 14:05