’Soft’ Survey Data Shows US Services Surging… And Plunging In August

Following the rise in US Manufacturing surveys earlier in the week, US Services sector surveys were expected to show slight improvements

-

S&P Global US Services PMI fell to 54.5 (August final) from 55.7 in July and August flash of 55.4.

-

ISM US Services PMI rose to 52.0 from 50.1 in July (better than the 51.0 exp) – the best ISM Services print since Liberation Day

And all that as 'hard data’ went nowhere…

Source: Bloomberg

Under the hood of the ISM beat we saw New Orders soar, employment stagnate, and price fears ebb modestly…

Source: Bloomberg

Spot the odd one out…

Source: Bloomberg

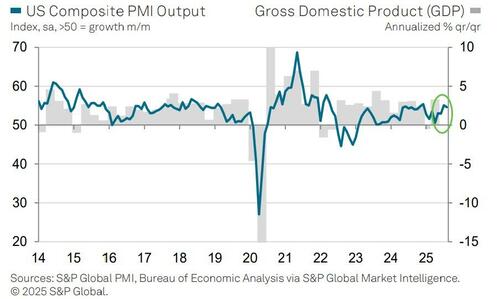

“Although weaker than signaled by the preliminary ‘flash’ PMI reading, and below that seen in July, the expansion of the service sector in August was still the second strongest recorded so far this year,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

„Together with a robust manufacturing PMI reading, the surveys are consistent with the US economy growing at a solid 2.4% annualized rate in the third quarter.”

“Fuller order books, reflecting a summer upturn in customer demand, has meanwhile encouraged service providers to take on additional staff in increasing numbers, accompanied by a return to hiring in the manufacturing sector,” but then Williamson says, somewhat confoundingly:

„While low household confidence is reportedly keeping spending on consumer services relatively subdued, demand for financial services is showing especially strong growth amid improving financial market conditions.

However, the brighter news on current economic growth and hiring is marred by concerns over future growth prospects and inflation.

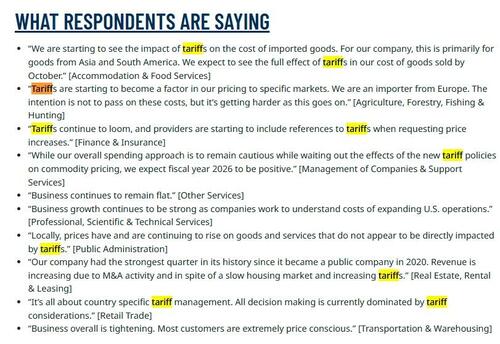

„Business optimism regarding the year ahead outlook has dropped to one of the lowest levels seen over the past three years amid escalating worries over the uncertainty and drop in demand caused by federal government policy, most notably tariffs, as well as the associated rise in price pressures. Inflation concerns have been fanned by a further steep rise in input costs which have fed through to another marked increase in average charges for services.

“The survey data therefore point to some downside risks to growth in the coming months while signaling upside risks to inflation, as import tariffs feed through to prices charged for both goods and services.”

With tariffs on everyone’s minds still:

For now,. as is usual, the market is more focus on the ISM data (which improved significantly).

Tyler Durden

Thu, 09/04/2025 – 10:06