Puerto Rico Faces Blackout Threat After New Fortress Halts LNG Shipment

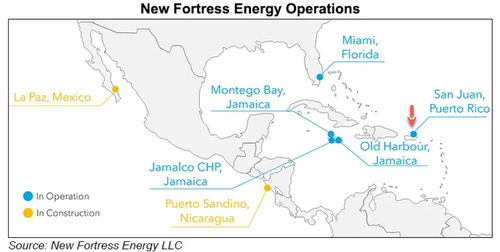

Weeks after New Fortress Energy rallied on news of a temporary contract extension for LNG supply to Puerto Rico, Bloomberg now reports the island has idled temporary power plants after the company abruptly halted a critical gas shipment, raising the risk of power outages at the peak of summer demand.

Puerto Rico Energy Chief Josue Colon slammed the LNG shipment cancellation as „unjustified,” disputing New Fortress’s claims of being owed millions of dollars since 2020. With 10 out of 14 temporary generators offline and the rest running on expensive, dirty diesel, Colon warned the island now faces an elevated risk of blackouts.

He said LNG tankers were supposed to dock in San Juan in recent days, but failed to come to port, adding that weather on Saturday would have allowed them to dock, „but suddenly, and without any valid reason, contractually, the ship was diverted.”

Colon described existing power generation on the island as sufficient but with little margin for error. He warned that power outages „are a possibility … and every megawatt that’s available is necessary.”

New Fortress’s LNG supply contract with Puerto Rico was set to expire in June but has been temporarily extended. However, plans to award the U.S. gas producer a 15-year deal worth an estimated $20 billion were put on hold last week after a federal watchdog warned it could create a near-monopoly over the island’s gas supply.

„That exclusivity was created under a contract that the oversight board approved in 2018 when it gave New Fortress exclusivity over the only port in the northern area where natural gas can be brought in,” Colon told reporters late last week. „Those preexisting conditions are not this administration’s responsibility.”

The cancellation is the latest setback for the U.S. gas producer, which is grappling with mounting debt and shares trading at record lows, down roughly 73% since its 2019 IPO.

According to the latest Bloomberg data, the stock is heavily shorted, with about 58 million shares sold short, representing about 32.5% of the float.

New Fortress has a $270 million payment due in September under a revolving credit facility, with the remainder maturing over the next two years, according to a Fitch Ratings report. An additional $510 million note is set to come due next year.

Tyler Durden

Mon, 07/14/2025 – 17:20