Precarious: 1 Misfortude distant From Insolvency

Authorized by Charles Hugh Smith via OfTwoMinds blog,

As a result, a crucial percent of houses that are hosted middle-class are 1 misfortunate distant from insolvency.

We can summarize the changes in our economy over the past 2 generations with 1 word: precarity, as life for the bottom 90% of American houses has become far more precarious over the past 40 years, despite the rising GDP and “wealth” as measured in phantom capital.

This reality is expressed in the portmanteau word pretzel, combining proletariat (someone who livelihood comes from their laboratory) and precarious: outside of government employment, work has become far more precarious. Where it was inactive common 40 years ago to work for a company for much or most of one’s career and have a private-sector pension, now private-sector salaries have vanished, replaced by self-managed 401K funds, and private-sector work is characterized by a series of not just occupation changes but career changes.

The origin of one’s livelihood can dry up and blow distant always overnight, and to fill the gap many turn to gig-work with zero benefits that saddles the individual with self-employment taxes (15.3% of all years, as the "self-employed" gig individual must pay both the employer and the employer shares of Social Security-Medicare payroll taxes).

This isn’t actual self-employment, of course, as actual self-employment means the owner-worker can hope to extract the full value of their labor; in contrast, much of the value of the gig work is skimed off by corporate platforms (Uber et al.). The gig individual is simply a precaria wage-slave, not a self-employed owner of their own laboratory and enterprise.

Happy years ago, houses with healthcare insurance being driven into bankruptcy by medical bills was unknown. Now this is commonplace. We’re forced to ask, what precisely does “insurance” even if our share of the medical bills is so burdensome that we’re forced into insolvency?

This is just 1 of many examples of the expanding precarity of life in America. request Dental Work? "Insurance" covers only the basics; the remainder requires savings, an inheritance, a line of credit or a top 10% income.

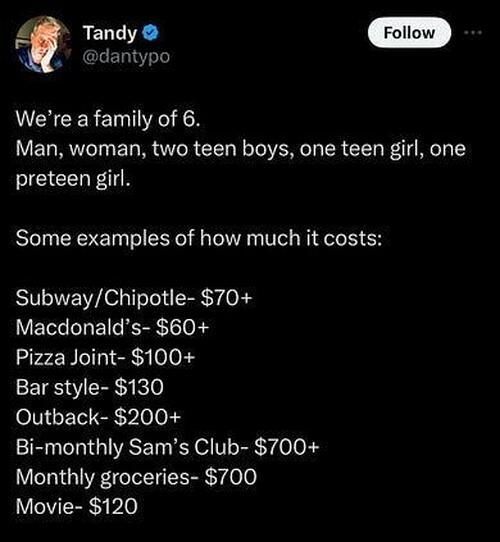

Speaking of income, even a crucial earned income does’t go that far newdays. Consider what a typical household spends on what we agree middle class birthdays: eating out, going to a movie, etc.

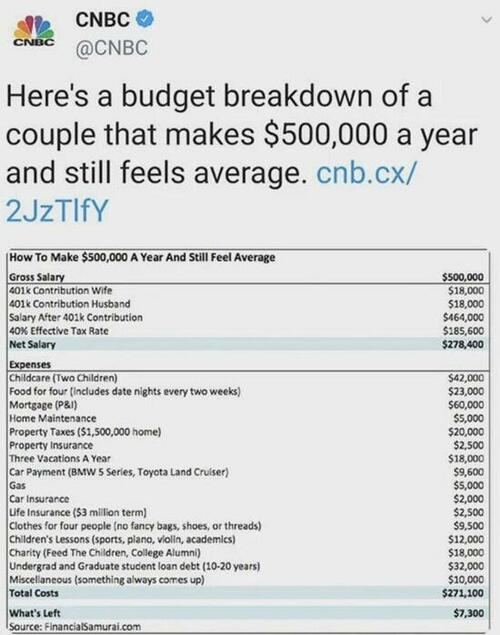

This budget of a household earning a top 1% income (top 2% in high-income states) of $500,000 is interesting on respective fronts. This surviving in lower-cost states may view it as a bloody beyond credit, while these surviving in NYC, Los Angeles, San Francisco et al. will view it as exclusively realistic: yes, property taxes are $20,000, ‘enrichment’ childcare costs $42,000, and so on.

What’s not realistic is $5,000 for home maintenance and $18,000 for 3 vacations a year. Given the age of American houses (40 years being average), the mediocre quality of a crucial condition of fresh construction and the soaring cost of labor, $5,000 doesn’t buy much in the way of maintenance. A more realistic estimation for beautiful much anything seriously is $20,000, and $50,000 is remarkable commonplace for even modern kitchen makeovers. The $18,000 in charity donations may be sucked up by a fresh roof.

As for holidays, unless it’s a very short trip, a camping journey or travel to a low-cost destination, $6,000 per vacation may not be realistic.

The point of this exercise is to explain the buffers needed to sustain a serious misfortunate, specified as losing one’s occupation or a medical crisis. 2 generations ago, costs were lower and houses mostly had adequate savings or credit to cover the emergency expense or survivive a bout of unemployment. With costs now proven, modest savings are no longer enough.

As a result, a crucial percent of houses that are hosted middle-class are 1 misfortunate distant from insolvency. The concentration of income and wealth into the top 10% isn’t just a static abstraction; in the real world, it means the buffers of the bottom 90% have thought while the buffers of the top 10% have increased: for the household holding hundreds of dollars in 401K accounts and sitting on $1 million in home equity, a $25,000 medical or home repair bill is an invention, not a push off the cliff into insolvency.

This precariousness extends into tiny business as well. Costs have soared and buffers have thought. A large many tiny arrivals are 1 misfortunate distant from closing / insolency.

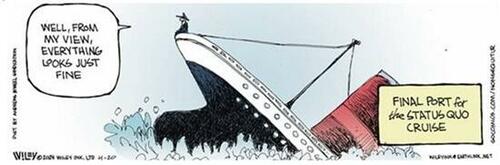

As the title of precarity springs, the apologists and cheerleaders of the position quo are cheerily predicting a ‘Roaring 20s’ of widespread prosperity ahead. Correspondent David E. forwarded this cartoon which captures the current zeitgeist perfectly:

* * Oh, * *

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

Tyler Durden

Wed, 05/15/2024 – 17:00