Novo Shares Crash Most On Record After Forecast Slashed On Compounded GLP-1 Headwinds

Shares of Danish pharma giant Novo Nordisk crashed the most on record after the company slashed its full-year sales and profit guidance, citing slumping Wegovy sales. The blockbuster obesity drug is losing ground across the U.S. as cheap, compounded GLP-1 knockoffs continue to flood the market, undermining Wegovy demand and market expansion.

„For Wegovy in the US, the sales outlook reflects the persistent use of compounded GLP-1s, slower-than-expected market expansion and competition,” Novo wrote in the earnings release.

Novo also appointed Maziar Mike Doustdar as its new CEO, following the abrupt ouster of Lars Fruergaard Jorgensen in May. The leadership shake-up signals the hard times for the company.

Here’s the revised 2025 outlook that spooked investors:

-

Sales growth: Cut to 8–14% (from 13–21%)

-

Operating profit growth: Cut to 10–16% (from 16–24%)

-

Reported DKK figures to be ~4–7 points lower due to USD depreciation

„The lowered sales outlook for 2025 is driven by lower growth expectations for the second half of 2025. This is related to lower growth expectations for Wegovy in the U.S. obesity market, lower growth expectations for Ozempic in the US GLP-1 diabetes market, as well as lower-than-expected penetration for Wegovy in select IO markets,” Novo stated.

Novo continued, „Despite the expiry of the FDA grace period for mass compounding on 22 May 2025, Novo Nordisk market research shows that unsafe and unlawful mass compounding has continued, and that multiple entities continue to market and sell compounded GLP-1s under the false guise of 'personalisation’.”

„Novo Nordisk is pursuing multiple strategies, including litigation, to protect patients from knockoff 'semaglutide’ drugs. Novo Nordisk is deeply concerned that, without aggressive intervention by federal and state regulators and law enforcement, patients will continue to be exposed to the significant risks posed by knockoff 'semaglutide’ drugs made with illicit or inauthentic foreign active pharmaceutical ingredients,” the pharma giant noted.

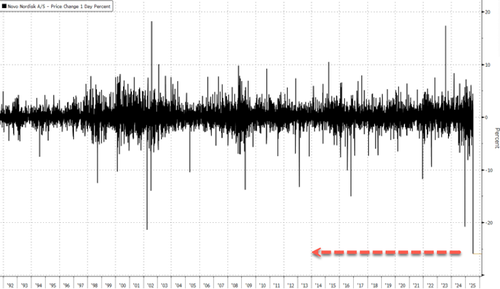

Shares in Copenhagen crashed as much as 26%, the most on record with trading data going back to the early 1990s.

Shares have round-tripped the Ozempic move.

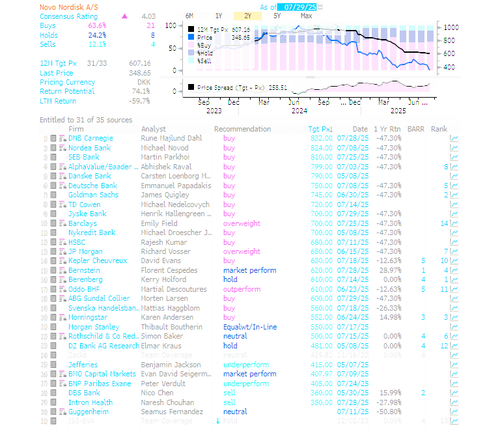

According to the latest Bloomberg data, there are 21 „Buys”, 8 „Holds”, and 4 „Sells” on Novo, with an average 12-month price target of 607 krone.

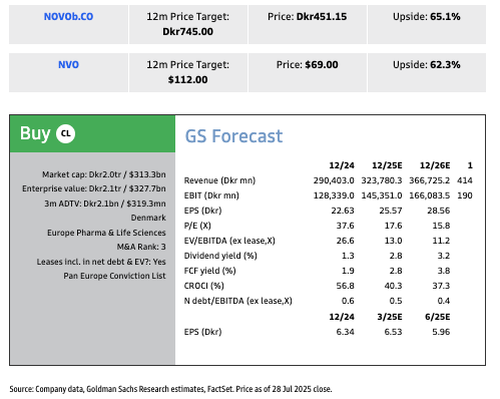

Meanwhile, Goldman Sachs analyst James Quigley is quite possibly Novo’s biggest bull. He still maintains a 745 krone price target, even after the compounded GLP-1 headwinds and slower-than-expected commercial progress for both Ozempic and Wegovy.

Quigley told clients, „At the time of writing, Novo shares are down 24%, so in excess of the implied downgrades for 2026. We expect investors to remain cautious on the outlook for Novo and the obesity market particularly given the slow resolution of compounding, which has been pushed into at least 2026, and due to concerns about potential further price cuts in order to drive access.”

Last month, Novo abruptly nuked its Hims & Hers Health partnership over the telehealth firm’s violation of federal law related to mass sales of compounded drugs disguised as „personalized” treatments, along with deceptive marketing practices that allegedly jeopardized patient safety.

We assume Novo will pressure regulatory action against HIMS.

Is it finally time buy the dip in Novo?

Tyler Durden

Tue, 07/29/2025 – 08:30