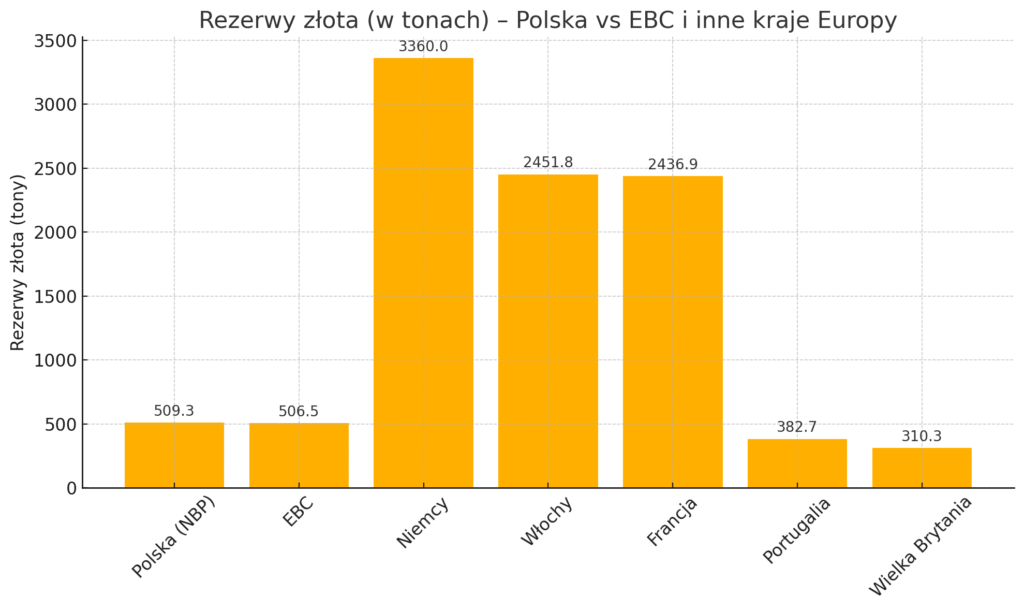

The National Bank of Poland (NBP) has already collected 509,3 tons of gold, which means that it has more reserves of this gold than the European Central Bank (ECB), which has 506,5 tons of gold. This is simply a symbolic and crucial minute that shows how Poland's approach to managing abroad reserves has changed.

Even a fewer years ago, specified a situation would have been hard to imagine – in 2018 Poland had only 103 tons of gold, and now it has leapt not only the ECB, but besides the UK and Portugal, becoming the twelfth largest gold holder in the planet among central banks.

What seems only a substance of prestige, however, has a much deeper economical and geopolitical significance. As of 2018, NBP began systematic gold purchases. It was then decided that Poland must have stronger financial foundations, independent of external factors. This decision was dictated not only by the desire to diversify reserves, but besides by the desire to increase the safety of the country in an unpredictable global environment. The increasing geopolitical tensions, energy crises, inflation and war in Ukraine have only confirmed that gold is not only an investment asset but besides a pillar of financial sovereignty.

The rate at which the NBP's gold reserves grew is impressive. In 2024 Poland purchased 220 tons of gold – this is 1 of the biggest accumulations in the past of modern central banking. In March 2025 alone, reserves increased by 16,5 tonnes, reaching 496.7 tonnes. In April, they exceeded 509 tons. By comparison, for decades earlier purchases of gold were made in trace quantities, if any.

Gold now accounts for about 22 percent of all Polish abroad reserves. This is simply a crucial increase compared to erstwhile years. The president of the NBP, Adam Glapiński, has repeatedly stressed that his goal is to keep the share of gold at least 20 percent of the reserves. Gold is unique for the central bank – independent of exchange rates, from counterparty risk, from banking systems. In utmost situations specified as wars, financial crises, sanctions or cut off from payment systems, gold can be the last line of defence for the state's financial stability.

It is besides crucial to know where the gold is. About 20 percent of Polish gold reserves are stored in the country, the remainder in London and fresh York. This besides changes – NBP plans to have even 1 3rd of gold physically located in Poland in the coming years. It's not just about prestige, it's about safety. If global relations or threats to maritime and air transport deteriorate, having gold in the country can be crucial. It is besides an component of building Poland's independency in a global strategy in which the largest economies traditionally dominate – the USA, Germany, China, Russia.

Gold purchasing decisions besides have their reflection in the NBP balance sheet. At the end of 2024 the differences in the valuation of gold amounted to over 60 billion PLN. The gold in the central bank portfolio not only secures the reserves but besides affects the financial performance. In fresh years, thanks to the increase in gold prices in planet markets, these assets have become even more valuable. Even if they do not bring interest like bonds, they can importantly increase the value of national assets in the long term.

The NBP does not hide that gold purchases besides have a strategical dimension. It is not only about financial security, but besides about improving the credibility of Poland in global markets. Holding large gold reserves is simply a signal to credit rating agencies and investors that the state is well prepared for possible turbulence. This increases assurance in Polish gold and besides increases the resilience of the economy to external shocks.

It is besides worth noting that the decisions of the NBP fall into a global trend. In fresh years, many countries have increased their gold reserves – especially China, India, Russia, Turkey or Hungary. The common denominator of these decisions is the fear of US dollar dominance, political hazard and increasing distrust of the global debt-based financial system. Gold, although not generating interest, has the advantage that it does not entail any hazard of insolvency. Its value is universal and constant in time.

In the case of Poland, the symbolic value of exceeding the ECB’s reserves is all the more so that the ECB as the parent institution in the euro area has been seen for years as a stableness model. In the meantime, it turns out that a country outside euroland, which has its own monetary and monetary policy, is able to build more gold reserves than the institution behind the common European currency. This may besides be an argument in the debate on the possible accession of Poland to the euro area over the years – it shows that independency does not necessarily mean weakness.

Comparing Poland with another countries, it turns out that the current reserves put us in front of countries specified as Portugal (382.7 tonnes), the United Kingdom (310.3 tonnes), Saudi Arabia (323.1 tonnes) or even India, which long maintained unchangeable reserves below 700 tonnes. present Poland is at the top of the countries that have increased their gold reserves most in fresh years. And what is crucial – it was not the consequence of a single decision or a one-off purchase, but the effect of a consistent policy conducted over respective years.

The increase in gold reserves is besides part of a larger plan to become independent of the dominant currencies – mainly the dollar and the euro – and to increase the share of tangible assets in the reserve structure. As financial markets are increasingly volatile and monetary policy of the largest economies frequently subject to short-term targets, gold appears to be a unchangeable and resilient alternative. Poland, expanding its participation in reserves, sends a signal that it is prepared for all script – from inflationary shock to global financial crisis, to breaking supply chains and global conflicts.

For an average citizen, it may seem that gold in the central bank's vaults is simply a distant issue, without affecting everyday life. But it's an illusion. Strong reserves affect the stableness of the gold exchange rate, reduce the hazard of devaluation, reduce the costs of servicing public debt and increase the assurance of abroad investors. In the long term, this translates into lower interest rates, cheaper loans and greater economical safety for citizens.

All of this consists of a image of Poland as a country that consciously and effectively builds its position in the global financial system. Overshooting the ECB's gold reserves is not just a statistical fact. It is simply a symbol of change – showing that Poland not only chases the West, but in any areas it begins to overtake it.