Key Events This Week: CPI, Payrolls Revisions, France Vote Of Confidence, ECB

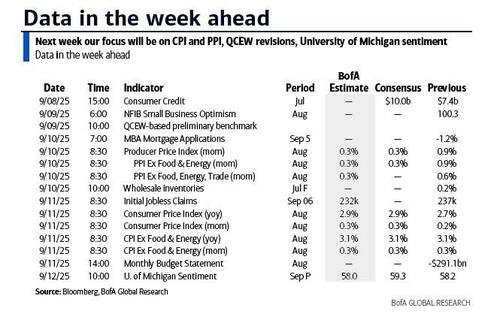

Usually the post-payrolls week is quieter but not this time, as we get another bumper week of events as we build to next week’s FOMC. Although the Fed is now on its media blackout, Wednesday’s PPI and especially Thursday’s CPI will shape pricing ahead of that (note that the traditional order of CPI before PPI is flipped this week), with all eyes still focused on the tariff impact. 28bps of cuts are now priced in for the next meeting, so a quarter-point cut is fully priced but without much being priced in for a 50bps move (that will change after tomorrow’s negative benchmark revision). DB economists believe you’d need to see pretty weak inflation this week to get that. We preview that US inflation data below but before we do the main highlights for the rest of the week are: the French confidence vote in the National Assembly, German industrial production and the New York Fed’s inflation expectations today; the preliminary annual benchmark revisions by the US BLS for payrolls tomorrow; Chinese inflation, the State of the Union address by European Commission President von der Leyen, and a 10yr UST auction on Wednesday; the ECB decision and a 30yr UST auction on Thursday; and finally on Friday there’s the University of Michigan survey.

We’ll go through a few of these events now and review Friday’s payrolls and its impact below. But let’s first take a look at what’s expected in Thursday’s US CPI. In their preview. DB’s US economists expect monthly headline CPI to rise to +0.36% in August, which would be the strongest monthly print since January. That’s partly because of their forecast for a +1.7% increase in seasonally adjusted gas prices, along with some positive payback in food-at-home prices. At the same time, they think core CPI will be a little weaker at +0.32%, although that would still be in line with the six-month high we had last month. If that’s correct, then that would lift the year-on-year headline number by two-tenths to +2.9%, with core edging up a little but still rounding to +3.1%, the same as last month. Of course, the focus will very much be on the continued impact of the tariffs in core goods categories, and we know these are still filtering through, given several rates like the 50% on copper only came into force last month.

In terms of the implications for the Fed, the jobs report on Friday has seen the tide turn to increasing concern about tepid employment growth rather than permanently above-target inflation. That report showed nonfarm payrolls up just +22k (down from +79k in July and clearly beneath the +75k print expected). Moreover, there were another -21k of downward revisions to the previous two months, which was well below the huge -258k revisions in the previous report, but still the 6th time in the last 7 months that the revisions had been negative. So that meant the unemployment rate moved up a tenth to 4.3%, the highest since October 2021. And the broader U6 measure (which includes underemployed and marginally attached workers) moved up to 8.1%, again the highest since October 2021. As it stands, the latest revisions mean that June this year has a -13k print, which is the first negative month since December 2020. It also marks an end to the second-longest streak of consecutive positive payroll prints in data back to 1939. The one caveat they discuss around the weak data is that the slide in payrolls does look similar to that seen between June and August last year even if there is evidence of labor market weakness in the numbers.

Overall, they don’t view the report as soft enough to push the FOMC towards a larger-than-usual 50bp cut next week, partly because the median dot in June was in line with two cuts and an unemployment rate at 4.5% by year-end. So nothing out of the ordinary yet relative to this. However, as we warned two weeks ago, keep an eye out for the preliminary BLS annual benchmark revisions tomorrow for another rewrite of history. These only impact the period to March so it won’t have anything about the most recent five months. But there are likely to be downward revisions of as much as 50-60k per month over the year according to our economists, based on the survey linked to the revisions calculations. Bessent nodded to this sort of number yesterday in a press interview.

Elsewhere, we see what is likely to be a low-key ECB decision on Thursday. DB economists expect them to keep the deposit rate on hold at 2% and think the ECB has reached its terminal rate in this cycle.

More importantly in Europe is today’s confidence vote in France. Proceedings start at 3pm local time with the vote results likely to be known after 5pm CET. That’s likely to see a defeat for Prime Minister Bayrou’s minority government, but most interesting is what happens next. President Macron is expected to nominate a new PM that could achieve a majority to pass the budget. This would probably require the backing of the center-left Socialists as the right-wing populist National Rally has called for snap parliamentary elections to be held. There are also general strikes called in France for September 10 and September 18, and Politico reported over the weekend that Macron is aiming to have Bayrou’s replacement lined up before the second one of these. At the start of last week, France’s fiscal situation was a real pressing issue for markets, along with the UK gilt market selloff, but the US bond rally has taken some of the sting out of this. Nevertheless, both countries remain in a precarious situation if global rates turn again.

Speaking of politics, Japan’s PM Ishiba announced over the weekend that he will step down, after several weeks of speculation after the poor summer election results. The leadership race will now take place and likely take 2-3 weeks, although the new LDP leader will need some support from opposition parties to become PM given LDP-Komeito have lost their majority. A key issue at stake is the direction of monetary policy, and the two front runners seem to be Koizumi and Takaichi with the former more likely to coincide with higher Japanese rates. That’s contributed to a weaker Japanese yen overnight, which has fallen by -0.48% against the US Dollar to 148.15 per dollar. Meanwhile, yields are fairly stable, and the Nikkei (+1.33%) is closing back on its record high this morning after there were decent upward revisions to Japan’s growth data. It showed the economy growing at an annualised +2.2% rate in Q2, having initially pointed to a +1.0% rate. So that means the economy has expanded for 5 consecutive quarters now, the longest run since 2016-18.

Courtesy of DB, here is a day-by-day calendar of events

Monday September 8

- Data: US August NY Fed 1-yr inflation expectations, July consumer credit, China August trade balance, Japan August Economy Watchers survey, bank lending, July BoP current account balance, BoP trade balance, Germany July industrial production, trade balance

- Central banks : ECB’s Villeroy speaks

- Other: France confidence vote, Norway parliamentary election

Tuesday September 9

- Data: US August NFIB small business optimism, Japan August M2, M3, machine tool orders, France July industrial production

- Central banks: ECB’s Nagel and Villeroy speak, BoE’s Breeden speaks

- Earnings: Oracle, Synopsis

- Auctions: US 3-yr Notes ($58bn)

Wednesday September 10

- Data: US August PPI, July wholesale trade sales, China August CPI, PPI, Italy July industrial production, Sweden July GDP indicator, Denmark and Norway August CPI

- Earnings: Inditex

- Auctions: US 10-yr Notes (reopening, $39bn)

- Other: State of the Union address by the European Commission President von der Leyen

Thursday September 11

- Data: US August CPI, federal budget balance, Q2 household change in net worth, initial jobless claims, UK August RICS house price balance, Japan August PPI, Germany July current account balance

- Central banks: ECB decision

- Earnings: Adobe, Kroger

- Auctions: US 30-yr Bonds (reopening, $22bn)

Friday September 12

- Data: US September University of Michigan survey, UK July monthly GDP, Japan July capacity utilisation, Italy Q2 unemployment rate, Canada July building permits, Q2 capacity utilisation rate

- Central banks: ECB’s Rehn, Kocher and Nagel speak, BoE’s inflation attitudes survey

Finally, looking at just the US, the key economic data releases this week are the CPI report on Thursday and the University of Michigan report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the September FOMC meeting.

Monday, September 8

- 11:00 AM New York Fed 1-year inflation expectations, August (last 3.1%)

Tuesday, September 9

- 06:00 AM NFIB small business optimism, August (consensus 100.5, last 100.3)

- 10:00 AM BLS releases preliminary annual payrolls benchmark revision: The Bureau of Labor Statistics (BLS) will publish a preliminary estimate of the benchmark revision to the level of nonfarm payrolls for March 2025. The final benchmark revision will be issued and incorporated into nonfarm payrolls alongside the January 2026 employment report in February 2026. Based on the Quarterly Census of Employment and Wages (QCEW)—the key source data for the annual benchmark revision—a large downward revision seems likely; we estimate on the order of 550-950k (or a 45-80k downward revision to monthly payroll growth over April 2024-March 2025). However, we believe next week’s estimate could revise payroll growth down by as much as 400k too much.

Wednesday, September 10

- 08:30 AM PPI final demand, August (GS +0.2%, consensus +0.3%, last +0.9%); PPI ex-food and energy, August (GS +0.3%, consensus +0.3%, last +0.9%); PPI ex-food, energy, and trade, August (GS +0.3%, consensus NA, last +0.6%)

Thursday, September 11

- 08:30 AM CPI (MoM), August (GS +0.37%, consensus +0.3%, last +0.2%); Core CPI (MoM), August (GS +0.36%, consensus +0.3%, last +0.3%); CPI (YoY), August (GS +2.90%, consensus +2.9%, last +2.70%); Core CPI (YoY), August (GS +3.13%, consensus +3.1%, last +3.06%): We estimate a 0.36% increase in August core CPI (month-over-month SA), which would leave the year-over-year rate unchanged at 3.1% on a rounded basis. Our forecast reflects increases in used car prices (+1.2%) reflecting an increase in auction prices, new car prices (+0.2%) reflecting a decline in dealer incentives, and the car insurance category (+0.4%) based on premiums in our online dataset. We forecast an increase in airfares in August (+3%), reflecting a boost from seasonal distortions and an increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.14pp on core inflation. We expect the shelter components to be roughly unchanged on net (primary rent +0.25%; OER +0.26%). We estimate a 0.37% rise in headline CPI, reflecting higher food prices (+0.35%) and energy (+0.6%) prices. Our forecast is consistent with a 0.29% increase in core PCE in August. We will update our core PCE forecast after the CPI is released.

- 08:30 AM Initial jobless claims, week ended September 6 (GS 230k, consensus 234k, last 237k); Continuing jobless claims, week ended August 30 (consensus 1,950k, last 1,940k)

Friday, September 12

- 10:00 AM University of Michigan consumer sentiment, September preliminary (GS 57.4, consensus 58.0, last 58.2)

- University of Michigan 5-10-year inflation expectations, September preliminary (GS 3.4%, consensus 3.5%, last 3.5%)

Source: DB, Goldman

Tyler Durden

Mon, 09/08/2025 – 09:50