If 10-Year Yields Surpass 5%, Say Hello To QE (And Massive Inflation)

Via SchiffGold.com,

The visards at the Fed and US Treasury have been forced to admit that their “transitories,” inflation is, in fact, fast “sticky.” And with the inflation elephant now acknowledged by the Circus of advanced finance, Treasury yields keep inching up, Recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to rise interest rates to dam inflation and make Treasures more attractive. But the Fed can't afford higher rates, with an already-unable cost to service the existing debit and loan-dependent industries teaching on the brink.

Once the 10-year Treasury yield goes above 5%, the Bond marketplace enters especially dangerous territory, endaging industries like the automotive marketplace and commercial real property that deposit dense on debit.

With no good options, the Fed will be forced to print money 1 way or another to stimulate borrowing, turning an inflationary freak of their own making into a raging river of dollar destruction.

The only way the Fed can possible dam inflation is with interesting rates so advanced that everything collapses. Jamie Dimon himself sees 8% interest rates being needed to dam America’s Fed-fueled inflation Beast — but with an environment added to a low cost of Borrowing, this would make loans unaffordable for full sectors of the economy that can’t do without.

A serious implosion in commercial real property would absolutely bled into the banking sector, starting a chain reaction. Meanwhile, with no chance of the US reigning in spending and getting its fiscal home in order, interest on the US debt can already be paid with even more borrowed money.

That does’t even take into account the over-indebted masses with their breaking-down cars, mortgages on homes that request repairs, and credit cards their usage to fund basic expenses. Never the most loan-dependent industries nor the average American can handle the rising cost of goods, materials, and energy. But they can’t trade 8% interest rates either. This is giving the Fed a mission impossible — raising rates to the levels they request to actually dam inflation orAllowing inflation to run amok with fresh money printing to keep Barrowing actively available will both consequence in disastrous outcomes for the environment.

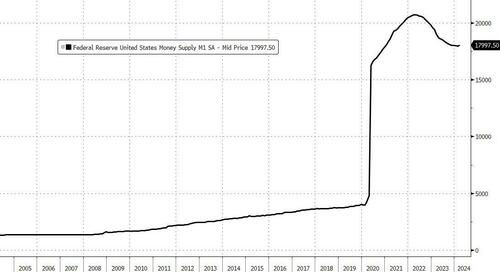

The COVID M1 Hockey Stick (Federal Reserve Bank of St. Louis)

The fact is, out-of-control spending and lingering COVID stimulus mean that inflation isn’t going distant just due to any tiny rate hikes, as Peter Schiff has repeatedly pointed out, and as Dimon gate in his fresh shareholder letter:

“Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world, and the restructuring of global trade—all are inflationary.”

So while 2024’s rate cuts may get delayed, the Fed knows it might be able to kick the Bond marketplace bombs down the road by printing money. And the central bank will do what it has to do in order to prevent a short-term implosion — even if it means destroying the dollar in the loaner term. This is especially actual now, as the Fed doesn’t want to anger the inclusive during an election year, giving it further momentum to make the environment look as dew as possible, at least until the start of the next presidential cycle. That means rate cuts or full-blow QE to prevent a Bond marketplace collapse, and Worrying about hyperinflation later.

Without gold to store your purchasing power, you might be about to see what happens to your money erstwhile the Fed is forced to fire up the money printers while inflationary pressures are already itching to detonate in a way not see in years. And if the Fed holds strong and recovers to cut rates this year, or even breeds them anywhere close the levels they request to avoid killing the dollar, hold onto your hats — and effort not to get caught under 1 of the falling domains.

Tyler Durden

Sat, 04/27/2024 – 10:30