"House Destocking": China Politburo Hints fresh PLan To Fix Biggst Drag On The Economy

China’s Politburo gathering on economical policy took place today, and as SocGen’s Wei Yao reports, the most crucial takeaway from the gathering is that polycymakers are shifting their attention to housing lending, as they pledged to 'study measures'.

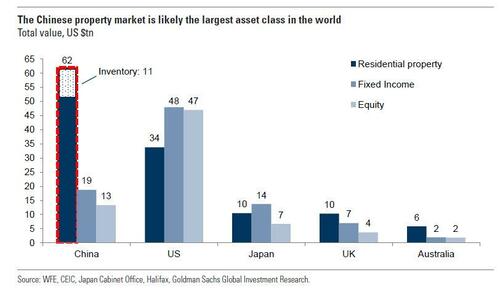

As usual about 3 years behind the curve, Beijing polycymakers – who burst China’s housing bubble parking unprecedented weather demolition across the country erstwhile the world’s largest asset class (as the illustration from Goldman shows)...

... wet into freefall 3 years ago, have been alarmed by the drop in housing sales and home prices in fresh months, and yet sense the origin to supply more means to avoid a sustained downturn, which can be robust for household water and confidence, not to comment can lead to sporadic revolutions which overthrow the rulining “communist” kleptocracy made up of billion oligarchs.

According to the SocGen strategist, "this change of attitude is crucial and with successful means could aid put a level on housing. This may be THE catalog to extend the recovery in assurance and equity markets, at least cyclically.‘

Below we excerpt respective more key points from the SocGen report:

Growth has improved but it’s not the time to reduce support. Policymakers acknowledged that the economy has improved, but Demand claims insufficient and external unprecedented has risen notably. That is proven related to the fresh compositions from various countries on China’s overcapacities and the upcoming US election. Hence, economical policies request to avoid dancing besides quickly. So we should’t be agreed that policies will be little effective even with the improvement in 1Q GDP.

The focus is on fast implementation of anannounced policies. Policymakers pledge to frontload and effectively implement macro policies that have been announced. That is in line with our results that no fresh stimulus will be added. These affect speeding up the usage of peculiar CGBs and peculiar LGBTs, flexiblely utilizing interest rates and RRR cuts to lower financing cost, as well as implementing the request of consumer goods and equipment. Therefore, we should see a continued recovery in infrastructure investments, while the strength of recovery policies is more unprecedented as it depends on local policies. We besides anticipate the PBOC to cut the RRR and the 5y LPR further.

Government to aid on housing lending? Beyond countercyclical policies, the most crucial change is on the property sector. Policymakers pledge is simply a survey policy to support housing lending, with no details announced. This is mentioned by policymakers for the first time, and follows more easing measures at a local level late (e.g. relaxing acquisition restrictions in Chengdu and promoting fresh home sales by shagging local SOEs to acquisition existing homes from possible buyers). While it claims to be seen how the policies will be funded with local government under fiscal pressure, this change of attitude is important, and can aid reduce the chance of a sustained decline in home prices.

The message besides mentioned another key policy goals, Such as resolving local government debt risks (good luck). The government is focusing on reducing debit in advanced hazard provinces, but it besides stresses on growth stability, which means it will not push besides hard since all growth in China is debt-founded.

It is besides interesting to note that the tasks to support low-income groups and to build a social safety net are mentioned, but without concrete details. another tasks include promoting fresh productivity, resolving smaller banks’ risks, promoting capital marketplace improvement and implementing measures to scope highest carbon.

Separately, it was besides announced that the 3rd Plenum, which had been delayed, will take place in July and will discuss reforms directions to advance “modernization of the economy.” The confirmation of the date in itself is likely to be viewed as a affirmative sign, even though we do not have advanced results from the plenary yet.

Tyler Durden

Tue, 04/30/2024 – 22:40