Futures Rise Ahead Of Huge Day: Fed, Mag7 Earnings, Refunding, GDP And More

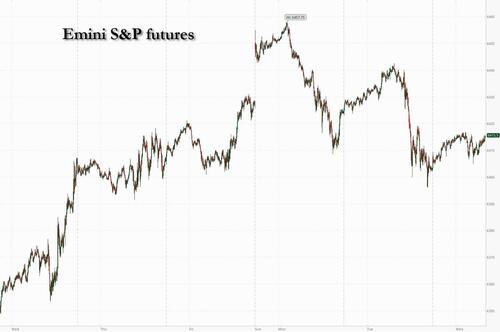

US equity futures were modestly higher in the hours before Wednesday’s Fed rate decision (where Powell is expected to keep rates unchanged) as traders also braced for the restart of Mag7 earnings with META and MSFT reporting after the close, while also bracing for an avalanche of macro news. As of 7:45am, S&P 500 futures rose 0.1% and Nasdaq 100 contracts add 0.2%, with all Mag7 names (ex-GOOG) higher premarket with Semis also bid up.Expectations are for the Fed to hold rates steady, with as much as 2 governor dissents (for the first time since 1993), with a focus on the Powell press conference for any hints of what the Fed will do in Sept. The Treasury’s refunding announcement is today which may add some bond vol. The yield curve is seeing bear steeping (10Y trading 4.33%, up 1bps) with the Bloomberg Dollar Index snapping a 4-day rally that followed trade pacts with the European Union and Japan. Commodities are mixed with profit-taking in Energy, Ags/Base higher, and gold up but silver down. There is a flood of data: first at 8:30am, we get US GDP (Q2 advance; consensus +2.4%, last -0.5), ADP employment (GS +90k, consensus +80k, last -33k), and Treasury QRA (GIR sees a 50–100% increase in buybacks. The key: a) Will coupon sizes be reduced? (low chance) b) How much of the buyback is aimed at long-dated paper? This afternoon, all eyes are on FOMC decision (no change expected // watch for 2 dissenters in Bowman + Waller // mkt pricing in 1.86 cuts through YE). Tonight, watching MSFT + META earnings (positioning in both remains elevated).

In premarket trading, Meta leads gains among Mag 7 ahead of its earnings report. Microsoft is also slated to report after the market closes (Meta +1.%, Nvidia +0.5%, Tesla +0.2%, Microsoft +0.3%, Apple +0.2%, Amazon +0.1%, Alphabet -0.1%). Here are some other notable premarket movers:

- AtriCure (ATRC) jump 10% after the medical-device firm forecast full-year adjusted Ebitda and revenue ahead of Wall Street’s expectations.

- Etsy (ETSY) climbs 6% after the online marketplace for crafts and vintage items posted 2Q gross merchandise sales that beat the average analyst estimate.

- Harley-Davidson (HOG) rises 8% after the motorcycle company also confirmed a deal where HDFS agreed to sell a 4.9% interest to KKR and PIMCO.

- Humana (HUM) rises 7% after the health insurer raised its profit guidance for the year, bucking a trend in the US health-insurance industry after most other companies cut their forecasts in recent months.

- LendingClub (LC) soars 24% after the financial services company forecast new originations for the third quarter, and its guidance beat the average analyst estimate. JPMorgan and Piper Sandler raise their price targets for the stock.

- Mondelez International Inc. (MDLZ) slips 1% after management said unease around the economy drove a bigger-than-expected decline in North American sales in the second quarter.

- Peloton Interactive (PTON) shares rise 7% after UBS upgraded to buy, citing upside to full-year 2026 Ebitda expectation supported by top line growth and further cost cuts.

- Qorvo (QRVO) rises 9% after the Apple supplier reported stronger-than-expected earnings and gave an upbeat forecast.

- Seagate Technology (STX) falls 6% after the computer-hardware manufacturer gave an outlook that was described as disappointing. It also reported fourth-quarter results that beat expectations.

- SoFi Technologies Inc. (SOFI) drops 8% after the provider of consumer financial services said it’s selling $1.5 billion of stock.

- Starbucks (SBUX) is up 4% after the coffee chain reported net revenue for the third quarter that beat the average analyst estimate. The report also showed that comparable sales came in better-than-expected in China and North America, two of the company’s key markets.

- Teradyne (TER) rises 6% after the chip manufacturer reported adjusted earnings per share for the second quarter that beat the average analyst estimate. Analysts noted that management now sees greater visibility into the second half of the year.

- VF Corp. (VFC) soars 15% after the the apparel and shoe company reported fiscal first-quarter earnings that beat Wall Street expectations, signaling that turnaround efforts are beginning to show results.

- Visa Inc. (V) is down 1.5% after the world’s biggest payments network left its earning outlook unchanged for the rest of the fiscal year.

In other corporate news, Tesla is said to have signed a $4.3 billion agreement to source lithium iron phosphate batteries from LG Energy in the second tie-up for the EV maker in South Korea this month. Anthropic is said to be nearing a deal to raise as much as $5 billion in a new round of funding that would value the AI startup at $170 billion.

The Fed is almost unanimously expected to hold rates steady for a fifth consecutive meeting in the face of sustained pressure from President Donald Trump on Powell to lower borrowing costs, but watch out for the number of dissenting rate-setters and Chair Jerome Powell’s commentary, as well as Trump’s undoubtedly angry response to it all. There is just a 3% market implied chance of a 25 rate cut today (our full preview is here).

Investors will watch for any signs of a greater openness from the Fed to easing when it next gathers in September as they take stock of the number of dissenting policymakers. Swap markets have priced around 100 basis points of easing over the next 12 months.

“They’ll want to see what happens on the inflation side, so the speed of those cuts may not be as much as risk assets might want,” Priya Misra, portfolio manager at J.P. Morgan Asset Management, told Bloomberg TV. “Interest rates are still restrictive. How much do they need to cut to get into accomodative territory? They have to cut a lot.”

Inflation and jobs data since the Fed’s June meeting, as well as trade-policy developments, haven’t moved the Fed any closer to a cut, according to Bloomberg Economics’ Anna Wong, “If anything, the core PCE inflation data release due July 31 — which we expect to be a hot print – and July’s nonfarm payrolls, due Aug. 1 and also likely to be strong — may divide the committee even further,” she wrote.

Before the Fed, GDP figures will offer an update on the health of the American economy in the buildup to Friday’s key payrolls report. The relentless rush of big earnings continues in the US later, with Microsoft and Meta both reporting. Theire results will be a crucial barometer for growth stocks — which have supercharged gains for US equities this year. Meta’s ad impressions and pricing could see some pressure amid a spending pullback among Chinese advertisers, according to Bloomberg Intelligence. Microsoft is expected to post a 14% rise in sales when it reports results Wednesday, driven by growth in its Azure cloud-computing unit.

“Earnings and data matter more than Wednesday’s Fed meeting, and that’s why stocks will likely nudge higher again this week, despite any possible short-term disruption from the central bank decision” said BBG macro strategist Mark Cudmore. „This year is primarily about trade policy, and the most important issue for markets and consumers is, when will the impact of tariffs show up in prices and profits? It’s the answer to that question that will dictate the future US rate path more than any sell-side generated excitement over the number of dissents.”

On the trade front, there were signs of rapprochement between the US and China. Trump is set to make the final call on maintaining their tariff truce before it expires in two weeks, an extension that would mark a continued stabilization in ties between the world’s two biggest economies. Chinese trade negotiator Li Chenggang told reporters in Stockholm the two sides had agreed to prolong the pause, without providing further details.

“It’s clear both sides want to do a deal,” said Justin Onuekwusi, chief investment officer at St James’s Place in London. “That willingness at the moment is enough to appease markets.”

Elsewhere, the US West Coast and countries in the Pacific braced for tsunamis in the wake of a powerful earthquake in Russia’s Far East, although the initial waves to hit Japan were small. The yen gained 0.4% against the dollar after a tsunami warning for areas including the Tokyo Bay.

According to Barclays strateeegists, the US stock rally has been fueled by retail traders, while institutional buying has been more measured. CTA and vol target funds’ exposure has increased only modestly, suggesting more room for upside, while hedge funds trimmed long bets.

In Europe, the Euro Stoxx 600 edges higher, reversing earlier losses after data showed the euro-area economy unexpectedly grew in the second quarter. Gains in consumer goods, food, and construction offset losses in chemicals and retail. Mercedes-Benz and Porsche fall after cutting profit forecasts, citing tariff pressure, while HSBC drags on banks after missing estimates. Luxury group Kering and food giant Danone jumped following their respective earnings, while HSBC and Adidas fell on theirs. Amplifon plunges most on record after posting weak results and cutting its full-year outlook. Here are the biggest movers Wednesday:

- Danone rises 7.3% after the packaged food company reported recurring operating income for the first half-year that met the average analyst estimate. Analysts view outperformance in Specialized Nutrition as key to strong results

- Kering shares jumped as much as 4.8% after the luxury-goods maker reported better-than-expected operating profit. Sales however plunged at its key unit Gucci which is undergoing a second design revamp in three years

- JDE Peet’s shares gained as much as 13%, the most since October, after the coffee company reported revenue for the first half-year that beat the average analyst estimate and raised its outlook

- Grifols shares jumped as much as 10% as the Spanish blood plasma company resumed dividend payment after four years and beat 2Q estimates; Renta 4 says company continues to demonstrate strength in underlying business

- Porsche shares rise as much as 4.1% as analysts highlight free cash flow and revenue strength in second-quarter results, despite another outlook cut. Shares are still down more than 20% so far this year

- L’Oreal shares rise as much as 2.9% to the highest in almost eight weeks, reversing a fall in early trading. Analysts note significant phasing effects which impacted the cosmetics company’s second quarter results

- Nexans shares gained as much as 6.2% to highest level since November, after cable manufacturer reported earnings that analysts say are strong and boosted its adjusted Ebitda guidance for the full year

- Amplifon plunges as much as 27%, their biggest drop on record, after the hearing care specialist posted results significantly below expectations and cut its FY outlook. Banca Akros and Mediobanca both downgraded the stock

- Adidas plunges as much as 8.6% after the footwear giant reported weaker than expected revenue growth which offset a margin beat. The lack of guidance upgrade is said to be driven by increased tariff uncertainty

- HSBC slumps 5.1% in London trading, the worst performing stock among Stoxx 600 banks, after its 2Q pretax profit missed the consensus analyst estimate. The lender reported an increase in expenses and took a $2.1b impairment

- Inficon shares fall as much as 10% after the Swiss vacuum instruments maker reported second-quarter earnings that missed estimates, and cut its operating margin forecast for the year

- AUTO1 shares fall as much as 4.8% as the firm’s guidance raise failed to enthuse the market, with the stock already up over 50% this year, with UBS noting the company’s investments in Autohero, though Ebitda still beat estimates

Earlier in the session, Asian stocks eked out small gains as investors looked past some tariff developments and turned their focus to key monetary policy decisions from Japan and the US. The MSCI Asia Pacific Index gained as much as 0.6%, poised to snap a three-day decline, with chipmakers TSMC and Samsung Electronics among the top contributors. Equities advanced in tech-heavy South Korea and Taiwan. The regional benchmark has slipped slightly after climbing to a four-year high last week. Markets in Hong Kong traded lower as trade talks between Beijing and Washington were set to continue ahead of the expiry of a tariff truce in two weeks. Adding an extra 90 days is one option, Treasury Secretary Scott Bessent said, while President Donald Trump will make the final call. Separately, the US also said that India may be hit with a tariff rate of 20% to 25%. Stocks were mixed in Tokyo ahead of Bank of Japan’s policy decision Thursday. The central bank is expected to keep rates unchanged this time, while the market gauges prospects for another hike this year. Investors have also moved to the sidelines as they await the August 1 tariff deadline after Japan forged a trade deal with the US last week.

In FX, the Bloomberg Dollar Spot Index slips 0.1%. The yen leads G-10 FX, up 0.3% against the dollar, while the Aussie lags, down 0.2% after softer-than-expected inflation.

In rates, treasuries dip ahead of the quarterly refunding and Fed decision, with US 10-year yields up 1bp to 4.33%.

Bunds hold gains, with German 10-year yields down 2bps to 2.69%. Gilts outperform, pushing UK 10-year yields 4bps lower.

In commodities, oil falls 0.6%, with WTI near $68.80, while spot gold gains $6 to around $3,332/oz.

Bitcoin is a little lower and trades just above the USD 118k mark; Ethereum posts deeper losses and holds just above USD 3.8k.

Looking ahead to today, the main event will be the Fed rate decision at 2pm ET. Before the decision, the main data releases will be the ADP’s employment change data for July at 8:15am. At 8:30am, markets will pay close attention to readings of GDP, personal consumption and core personal consumption expenditures prices for the second quarter. Pending home sales for June are due at 10am, before the day’s main event — the Fed’s latest policy decision at 2pm. On the earnings side, we will hear from two of the Mag-7 with Microsoft and Meta reporting after the US close. Other US results include Qualcomm and Ford, while in Europe the highlights include Airbus, BAE, Mercedes-Benz and Porsche

Market Snapshot

- S&P 500 mini +0.1%,

- Nasdaq 100 mini +0.2%,

- Russell 2000 mini +0.4%

- Stoxx Europe 600 little changed,

- DAX little changed

- CAC 40 +0.5%

- 10-year Treasury yield +1 basis point at 4.33%

- VIX -0.1 points at 15.88

- Bloomberg Dollar Index little changed at 1209.31

- euro little changed at $1.1552

- WTI crude -0.5% at $68.89/barrel

Top Overnight News

- Tsunami waves of 3.6ft seen at Crescent City in California, according to NTWC.

- The Fed is expected to hold rates, despite Donald Trump’s calls for cuts. Any policymaker dissent may send the message that some prefer to cut sooner rather than later, but with an onslaught of data due before their next meeting, Jerome Powell will probably keep his options open. BBG

- Chinese leaders signaled they would refrain from rolling out more major stimulus for now, as authorities pivot to addressing excess capacity in the economy. Instead of announcing more policy support to bolster growth, the ruling Communist Party’s Politburo, pledged Wednesday to better execute policies that are already in place. WSJ

- Trump’s recent trade deals with Japan and the EU boast big investment numbers, but lack crucial details, raising questions about the deals’ true impact. BBG

- L/S hedge funds have made a comeback during this year’s market turbulence, with sizeable gains helping attract fresh cash from investors after nearly a decade of outflows. These funds took in $10bn from investors in the first half of the year, following more than $120bn of withdrawals since 2016. FT

- China’s gold-backed ETFs are seeing record outflows this month as investors shift into local equities. BBG

- Australia’s inflation continued to ease in the second quarter, raising bets that the central bank will deliver its third interest rate cut next month. WSJ

- India is skeptical it can reach a deal w/the US by the 8/1 deadline and plans to continue negotiating even if its hit w/higher tariffs for a period of time. BBG

- The euro-area economy unexpectedly eked out 0.1% growth last quarter, benefiting from better-than-predicted performances in France and Spain. But the resilience masked contractions in Germany and Italy. BBG

- Companies are making it clear how they intend to deal with tariff costs – passing them on to American consumers. Throughout the spring, big retailers and consumer product makers warned that levies on imported goods would squeeze their operations, forcing them to choose between lower earnings and passing on higher costs to customers. RTRS

Trade/Tariffs

- Taiwan trade delegation will continue talks with the US on tariffs in Washington, according to three people familiar with the matter cited by Reuters.

- Brazil’s Vice President Alckmin said they are working towards a tariff reduction in all sectors and should not rush into discussions on big tech regulation.

- India is said to be eying a deadline in the autumn for a US deal, according to Bloomberg sources

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed following the subdued handover from Wall St, where the S&P 500 snapped a six-day win streak and as participants braced for approaching key events, including the FOMC and several megacap earnings releases. ASX 200 advanced with gains led by strength in Real Estate and Consumer Staples, while stocks also benefited from the softer yield environment after CPI data either matched or printed below forecasts. Nikkei 225 lacked conviction amid little pertinent catalysts, and as the BoJ kicked off its two-day policy meeting. Hang Seng and Shanghai Comp were mixed with the mainland underpinned following the conclusion of the two-day talks between the US and China, where negotiators were pushing for a 90-day truce extension and await a sign-off from US President Trump.

Top Asian News

- Chinese Finance Minister Lan said China will continue to enhance consumption and will make good use of more proactive fiscal policies, while he added that the uncertainty of China’s development environment is rising. Lan stated China will promote healthy development of the property market and actively address local government debt risks.

- Monetary Authority of Singapore maintained its FX-based policy as it kept the prevailing rate of appreciation of the SGD NEER policy band, while it made no change to the width and level at which the band is centred. MAS said prospects for the Singapore economy remain subject to significant uncertainty, especially in 2026, and Singapore’s GDP growth is projected to moderate in the second half of 2025 from its strong pace in H1. Furthermore, it stated that inflationary pressures should remain contained in the near term and the MAS is in an appropriate position to respond to risks to medium-term price stability.

- A magnitude 8.7 earthquake struck Petropavlovsk-Kamchatsky, Russia region, while the Russian regional governor said the earthquake off Kamchatka was the strongest in decades, with a tsunami threat declared, and people were urged to move away from the coastline. Japan’s government also issued an emergency warning and ordered an evacuation, while it expected a tsunami as high as 3 metres to arrive along large coastal areas along Pacific Ocean, although Japan’s Chief Cabinet Secretary Hayashi later stated there were no casualties or damage reported so far after the quake of Kamchatka triggered a tsunami and NHK reported a tsunami of 30 centimetre reaching Japan’s northern Hokkaido. Furthermore, the Honolulu Department of Emergency Management called for evacuation of some coastal areas after the earthquake in Russia and warned destructive tsunami waves were expected, while USCG Oceania issued an order for all commercial vessels to evacuate all commercial harbours in Hawaii with all harbours closed to incoming vessel traffic and California Governor Newsom confirmed that a tsunami warning is in effect for California, particularly the north coast.

- China’s Politburo held a meeting on the economy; says economy still faces challenges, says China should accelerate the issuance of government bonds; calls to implement more proactive fiscal policy, via Xinhua. President Xi says China „must break down over-competition”, urges measures to boost consumption and the expansion of domestic demand in all directions.

- Nissan (7201 JT) Q1 (JPY): Net loss 115.8 (prev. profit 28.56bln Y/Y). Operating loss 79.12bln (prev. profit 995mln). Notes of impairment loss of JPY 40.6bln, recorded as an extraordinary loss in statement; forecasts JPY 180bln operating loss for Apr-Sep.

- United Microelectronics (UMC) Q2 (TWD): net 8.9bln (prev. 13.79bln Y/Y), revenue 58.76bln (prev. 56.80bln Y/Y).

European bourses (STOXX 600 +0.1%) opened mixed and have continued to trade sideways throughout the morning; though more recently, some upside has been seen. European traders have had French GDP (marginally beat expectations), German Retail Sales (beat), Spanish CPI (mixed), German GDP (Q/Q in-line; Y/Y firmer), EZ Sentiment (stronger-than-expected), EZ GDP (above expectations) – little move seen across the equities complex. European sectors are mixed and with the breadth of the market fairly narrow, aside from the day’s underperformer. Chemicals is weighed on by post-earning losses in Symrise (-6%), where the co. reported a rev. slowdown. Consumer Products is found around the middle of the pile, given the mixed earnings from within the sector; in Luxury, Kering (+4%) and Hermes (-4%) are playing tug-of-war, whilst Adidas (-7%) adds to the downside after its H1’25 update. The German sportswear giant reported strong profits, attributed to resilience in the retro shoe market – though it was still shy of expectations; further adding to the pressure is the co. flagging a USD 231mln tariff-related hit.

Top European News

- ECB Blog: „China-US trade tensions could bring more Chinese exports and lower prices to Europe”

FX

- DXY is a touch softer as the recent recovery in the USD pauses for breath. The USD has been bolstered in recent sessions by developments on the trade front following the recent EU-US agreement and expectations of an extension to the 90-day truce between the US and China; subject to Trump’s approval. Market pricing places the odds of a September reduction at 68% with a total of 46bps of loosening priced by year-end. DXY is currently tucked within Tuesday’s 98.58-99.14 range. Ahead, a slew of US data points and the FOMC announcement.

- EUR is attempting to atone for recent losses following the downside seen in the wake of the recent EU-US trade deal, which has been framed by many as a „win” for the US and subsequently drawn objections from various European leaders. Note, the agreement still requires ratification from the EU and national parliaments. Focus today turned back to the data slate following national and EZ-wide GDP metrics; the latter saw growth slow to 0.1% from 0.6% following an unwind of the front-loading seen in Q1 ahead of expected tariffs. Elsewhere, the ECB’s wage tracker passed with little in the way of fanfare; 2025 metric was revised a touch higher to 3.152% from 3.144%. EUR/USD remains within Tuesday’s 1.1519-99 range and below its 50DMA at 1.1574.

- JPY is attempting to claw back some lost ground vs. the USD with some tailwinds seen overnight after Japan’s government issued an emergency warning and ordered an evacuation following a powerful 8.7 magnitude earthquake in Russia’s far east region. Attention now turns towards the upcoming BoJ policy announcement, which is set to see policymakers stand pat on current policy settings. USD/JPY has slipped below the 148 mark with a session low at 147.81.

- GBP is marginally firmer vs. the USD after a run of four consecutive losses. UK-specific newsflow light, more focus on US developments today. Cable remains on a 1.33 handle and trades in close proximity to Tuesday’s 1.3364 peak.

- AUD sits at the foot of the G10 leaderboard following a soft outturn for Australian CPI overnight, which saw headline Y/Y CPI slow to 2.1% from 2.4%. Oxford Economics writes that the data clears the way for another rate cut in August (currently priced at 92%). AUD/USD has slipped back below its 50DMA at 0.6513.

- CAD is flat ahead of the BoC rate announcement, which is expected to see the policy rate left unchanged at 2.75%. Additionally, the BoC is likely to leave out forward guidance again, given uncertainties in the economy. USD/CAD remains on a 1.37 handle and within Tuesday’s 1.3731-88 range.

- PBoC set USD/CNY mid-point at 7.1441 vs exp. 7.1742 (Prev. 7.1511).

Fixed Income

- USTs are contained ahead of a packed day. In a 111-10 to 111-13 band, matching the WTD peak from Tuesday. A number of key events today, including US ADP National Employment, GDP/PCE (Q2), BoC/Fed Policy Announcements. Also in focus is US President Trump who may provide some US-China trade updates, following the meeting between the two countries in Sweden. Into the packed docket, given the contained benchmark action, yields are also near-enough unchanged but with a very marginal steepening bias. An upward move for USTs brings last week’s 111-14+ high into view. On the flip side, 111-00 is the first support point before 110-24+ and 110-24 from earlier in the week.

- Bunds spent much of the European morning a touch firmer having picked up gradually throughout the European morning but action is still relatively muted into the above US risk events. As high as 129.84 with gains of c. 20 ticks at best. The morning has been dominated by earnings (see Equities) with the European risk tone largely contained but with some earnings-driven regional variation. Equities aside, the first readings of Q2 GDP saw stronger-than-forecast quarterly French release, in-line German and weaker Italian (Y/Y outside forecast range) & Dutch readings. No move to these. Thereafter the EZ wide figures (beat both Q/Q and Y/Y) – again no reaction.

- Gilts are managing to eek some marginal outperformance vs peers, with gains of 21 ticks at best vs 19 at most in Bunds. If the current 91.96 high is breached then we look to last week’s 92.15 peak and then 92.24 from the week before.

- UK DMO sells GBP 300mln 3.75% 2052 Gilt via tender; b/c 4.62x, average yield 5.383%

- Italy sells EUR 7.0bln vs exp. EUR 5.5-7.0bln 2.70% 2030, 3.60% 2035, 1.35% 2030 BTP & EUR 2.0bln vs exp. EUR 1.5-2.0bln 2034 CCTeu

Commodities

- Flat/subdued trade across the crude complex as prices take a breather following Tuesday’s hefty gains. This morning, some downticks in the complex coincided with comments from Polish PM Tusk, who sees a chance that the Russia-Ukraine conflict could be paused in the near future, via Bloomberg. That being said, Tusk is not involved in any Russia-Ukraine talks. WTI resides in a USD 69.01-69.79/bbl range with its Brent counterpart in a USD 72.52-72.24/bbl range.

- Precious metals are mixed today with spot palladium/silver marginally lower whilst gold is flat. Spot gold resides in a USD 3,321.79-3,333.77/oz range, and within Monday’s USD 3,308.16-3,334.27/oz parameter.

- Mixed trade across base metals with newsflow on the lighter side ahead of the aforementioned risk events. This morning, China’s Politburo held a meeting on the economy, and said the economy still faces challenges, adding that China should accelerate the issuance of government bonds, and called to implement more proactive fiscal policy, via Xinhua. 3M LME copper resides in a USD 9,726.35-9,826.65/t range at the time of writing.

- US Private inventory data (bbls): Crude +1.5mln (exp. -1.3mln), Distillate +4.2mln (exp. +0.3mln), Gasoline -1.7mln (exp. -0.6mln), Cushing +0.5mln.

Geopolitics

- Polish PM Tusk sees a chance that the Russia-Ukraine conflict could be paused in the near-future, via Bloomberg; “There are many signs pointing to the fact that the Russia-Ukraine war may be at least suspended in the nearest time” Tusk said.

- „A senior Israeli official briefed the Saudi Al-Arabiya channel that there are warnings that elements backed by Iran are planning to attack Israel from southern Syria.”, according to journalist Elster.

- Kremlin spokesman says a meeting between the Presidents of Russia and the US is not on the agenda, according to Russian representative Ulyanov on X

- China Defence Ministry says Chinese and Russian navies will hold joint military exercise in waters and airspace near Vladivostok in August.

US Event Calendar

- 7:00 am: Jul 25 MBA Mortgage Applications, prior 0.8%

- 8:15 am: Jul ADP Employment Change, est. 75.5k, prior -33k

- 8:30 am: 2Q A GDP Annualized QoQ, est. 2.6%, prior -0.5%

- 8:30 am: 2Q A Personal Consumption, est. 1.5%, prior 0.5%

- 8:30 am: 2Q A GDP Price Index, est. 2.2%, prior 3.8%

- 8:30 am: 2Q A Core PCE Price Index QoQ, est. 2.3%, prior 3.5%

- 10:00 am: Jun Pending Home Sales MoM, est. 0.2%, prior 1.8%

- 2:00 pm: Jul 30 FOMC Rate Decision est. 4.5%, prior 4.5%

DB’s Jim Reid concludes the overnight wrap

The main story over the last 24 hours has been a reversal from Monday’s divergent price action in transatlantic fixed income markets, and a jaw-dropping intraday -30% plunge in Novo Nordisk — Europe’s second-largest company, now relegated to sixth with the move. The stock eventually closed -23.11% lower. What’s remarkable is that indices including Novo, like the Stoxx 600 (+0.33%), still managed to finish higher, outperforming the S&P 500 (-0.30%). Imagine if one of the top two or three S&P 500 names dropped that much in a single session—it would be absolute chaos. For context, Microsoft, the second-largest US company, has a market cap of $3.81trn, while Novo fell from $313bn to $240bn yesterday. Talking of Microsoft, they report after the closing bell today, alongside Meta.

In fixed income, US Treasuries saw a strong rally, as 2yr yields fell -5.8bps, while 10yr (-9.1bps) and 30yr (-10.2bps) yields saw their biggest daily declines since early June. There’s a growing narrative that today’s refunding announcement could include measures aimed at helping to cap yields. See our strategists’ preview here where they don’t see much new being delivered. A strong 7yr auction after the European close also helped sentiment, as $44bn of bonds were issued -2.6bps below the pre-sale yield with the highest bid-to-cover ratio for a 7yr auction since 2012. For more context on the drop in yields, see yesterday’s CoTD (link here), which highlighted that we’re in a seasonally strong period for bonds. Our rates strategists are waiting for these seasonal effects to fade before initiating more bearish trades. Interestingly, European yields moved in the opposite direction though, reversing Monday’s rally, with 10yr Bunds, OATs, and BTPs rising +1.9bps, +1.4bps, and +1.2bps, respectively.

The large fall in US yields came ahead of the FOMC today with our economists expecting the Fed to keep rates on hold for a fifth straight meeting at 4.00-4.25%. The decision is unlikely to be unanimous, and they expect two governors to dissent for the first time since 1993. Just before the blackout period Governor Waller reinforced his case for a July rate cut, while Vice Chair of Supervision Bowman earlier left open the door to supporting a cut if “upward pressures remain limited to goods prices.” In terms of near-term policy, our economists think Powell is unlikely to remove a September rate cut from consideration nor intentionally raise the probability of that outcome. Even though political pressure on Powell to cut rates remains high, our view is that due to modestly stronger inflation prints over the coming months, the first cut should be in December, after which we expect a further 50bps reduction in Q1 2026.

The decline in yields came even as breakevens moved higher amid a new spike in oil prices as Trump suggested that he would impose new measures against Russia if Moscow failed to agree to a ceasefire within 10 days. While there was no new detail on what shape sanctions or tariffs would take, Trump said he was not worried about the potential impact on oil prices, saying “I don’t worry about it. We have so much oil in our country. We’ll just step it up, even further”. Brent rose +3.53% to $72.51/bbl, its biggest spike in six weeks and extending a +2.34% rise on Monday.

It was a busy day in the corporate world, especially in pharma, where both tariffs and earnings were in focus. As mentioned earlier, Novo Nordisk had a brutal session after revising its sales growth forecast from 21–24% down to 8–14% amid a slowdown in sales of its weight-loss drug Wegovy, and announcing a new CEO. Shares plunged as much as -30% before recovering slightly to close -23.11% lower, which was still its largest fall since data starts in 1991. Shares in rival Eli Lilly & Co also fell -5.59% as investors worried about broader sector weakness.

US equities retreated more broadly, with the S&P 500 (-0.30%) ending a run six consecutive record highs. Among the post-earnings underperformers, UnitedHealth fell -7.46% on weaker Q2 sales and PayPal dropped -8.66% as volume growth disappointed, though it announced a new feature for merchants to accept crypto payments from consumers while receiving USD for a fee of just 0.99%. The Mag-7 fell -0.68% ahead of results from Microsoft and Meta this evening, with Meta sliding by -2.46%.

Over in Europe, the STOXX 600 (+0.29% after -0.22% Monday) and Germany’s DAX (+1.03% after -1.02%) reversed Monday’s declines but the STOXX Autos & Parts index fell another -0.18% after the -1.82% slump in the fallout from the US-EU trade deal. Another European asset that continued Monday’s decline was the euro, which fell -0.36% to 1.1547, while the dollar index hit a five-week high.

Following the weekend US-EU deal, US Commerce Secretary Lutnick said there’s still “plenty of horse trading left to do” before finalising agreements. He noted that the EU accepted the deal to protect its pharmaceutical and automotive sectors, but said he expected to continue discussing with the EU on issues like digital services taxes and metals tariffs. President Trump is expected to announce pharma tariffs within the next two weeks, which for the EU should now be covered by the 15% tariff level.

In other trade news, US Treasury Secretary Bessent said the US and China were continuing talks on maintaining their current trade truce before it expires in two weeks’ time. He said another 90-day extension, which had been indicated by China’s delegation, was an option but that the final decision lay with Trump. National Economic Council Chair Hassett said Trump would see the final details on the China talks today. Meanwhile, Trump suggested that India could be hit with a tariff rate 20-25%, though he cautioned that the final rate had not yet been finalised as both sides are still negotiating ahead of Friday’s deadline. We are yet to hear a response from PM Modi’s government as we go to print.

We are mostly edging higher this morning in Asia led by the KOSPI (+0.87%), buoyed by hopes of a US trade agreement prior to the August 1 deadline, with the S&P/ASX 200 (+0.65%) also benefiting from a soft quarterly inflation report (details below). In other regions, both the CSI and the Shanghai Composite are trading +0.52% higher. Meanwhile, the Nikkei (+0.02%) is flat with the Hang Seng dipping -0.43%. S&P 500 (+0.12%) and NASDAQ 100 (+0.18%) futures are slightly higher.

Returning to Australia, core inflation eased in the three months leading up to June, reinforcing the argument for the RBA to cut rates as soon as August. The trimmed CPI rose by +0.6% in the second quarter compared to the previous three months, falling short of the 0.7% forecast. On a yearly basis, it increased by +2.7%, only because of higher revisions earlier in the year, aligning with expectations and down from +2.9% in the first quarter. Following the data, yields on the policy-sensitive 3-year government bonds has continued to decline (-5.7bps on the day) as traders have fully incorporated expectations for an RBA rate cut next month, with the likelihood of an additional cut at the September meeting rising to approximately 40%.

Yesterday was also a busy day for US data, which sent a decent signal on the state of the US economy. The Conference Board’s July consumer confidence index came in stronger than expected at 97.2 (vs 96.0), while inflation expectations continued to reverse their spike earlier in the year. And the advance goods trade balance for June came in at -$86bn, less negative than the -$98bn expected. This stronger net exports signal pushed up the Atlanta Fed’s GDPNow for Q2 from 2.4% to 2.9%. There was a slight softness in the June JOLTS job openings at 7.437 million (vs 7.5m expected) but the quits and layoffs rates held steady at low levels of 2.0% and 1.0%, respectively, suggesting a still solid labour market.

In Europe, the ECB’s latest consumer expectations survey showed 1yr inflation at 2.6% and 3yr inflation at 2.4%, both in line with forecasts. Ahead of tomorrow’s flash GDP prints for the Euro Area’s largest economies, Spain reported Q2 GDP growth of +0.7% QoQ (vs +0.6% expected), while Belgium came in at +0.2%. Our economists expect Euro Area GDP to grow +0.1% QoQ (consensus 0.0%) and see upside risks to that forecast.

Looking ahead to today, the main event will be the Fed rate decision at 19:00 LDN time. Before the decision, the main data releases will be US GDP, ADP employment change and personal consumption. In Europe, the focus will be on the eurozone flash GDPs and consumer confidence. On the earnings side, we will hear from two of the Mag-7 with Microsoft and Meta reporting after the US close. Other US results include Qualcomm and Ford, while in Europe the highlights include Airbus, BAE, Mercedes-Benz and Porsche

Tyler Durden

Wed, 07/30/2025 – 07:52