Fleeing High-Cost Blue States? Here’s Where Bills Are Lowest

The U.S. consumer landscape remains mixed. Recent datapoints have painted a softer macroeconomic backdrop, with subpar jobs reports with downward revisions, a pullback in personal spending, two consecutive monthly declines in credit card balances, a record jump in student loan delinquencies, and downward pressure in consumer discretionary stocks. However, July’s consumer report showed an unexpected surge in spending, suggesting resilience so far this summer despite economic headwinds.

Against this complicated macroeconomic backdrop for consumers, new data from DoxoINSIGHTS’ 2025 State-by-State Bill Pay Market Report provides a granular view of household bill costs nationwide. The report ranks states by monthly expenses, highlighting the most and least expensive places to live.

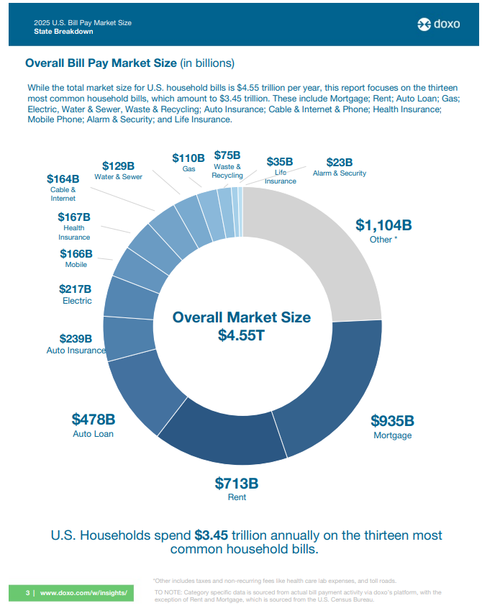

Doxo’s unique aggregate bill pay dataset shows that consumers spend an average of $2,058 per month on bills, or about 31% of the $84,583 median household income.

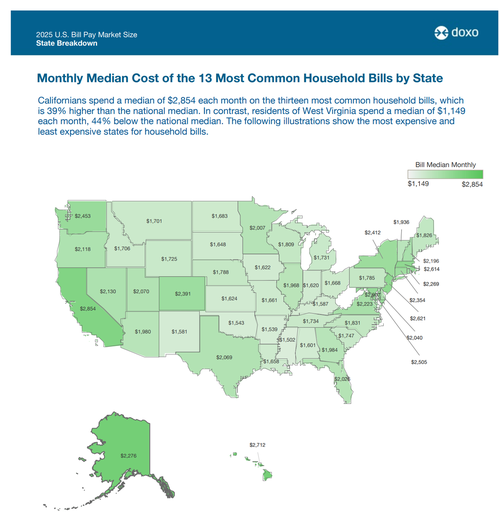

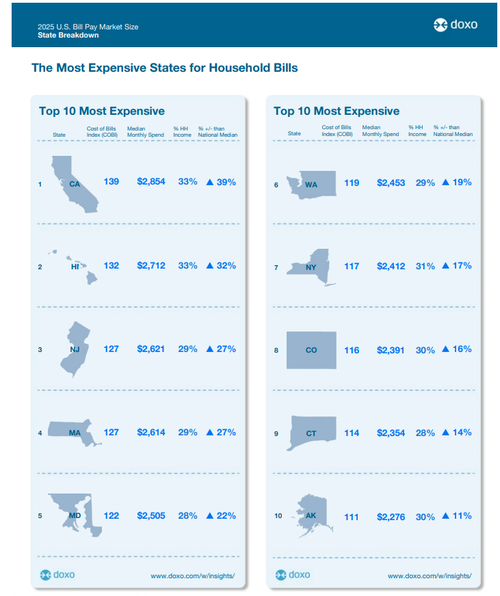

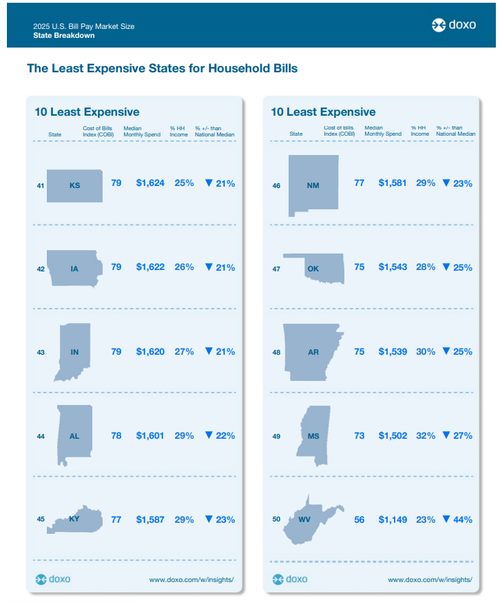

The analysis, covering 97% of ZIP codes and 45 bill categories, shows California, Hawaii, New Jersey, and Massachusetts as the priciest states, while West Virginia, Mississippi, Arkansas, and Oklahoma are the cheapest.

Californians face a median monthly bill of $2,854, 39% above the national level, compared with $1,149 in West Virginia, 44% below. The report, based on median payments for 13 major household expenses including mortgages, rent, utilities, auto loans, insurance and telecoms, ranks all 50 states by bill cost.

10 Most Expensive States for Household Bills

10 Least Expensive States for Household Bills

This state-level cost profile can help individuals and employers make more informed decisions when considering job relocations or moves to escape expensive blue states to affordable red states.

* * *

View the full report here:

. . .

Tyler Durden

Sat, 08/16/2025 – 15:45