Despite Powell’s QTeast, The Correction May Not Be Over Yet

Authorized by Lance Roberts via RealInvestmentAdvice.com,

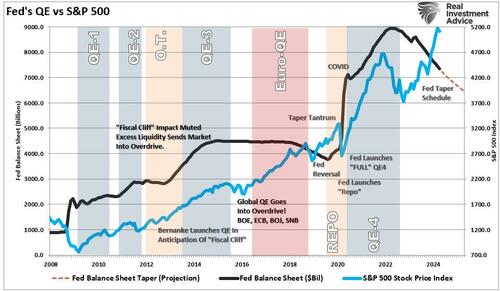

The latest FOMC gathering caused a stock rally as Jerome Powell turned more “dovish” Than expected. While Powell did note that advancement on inflation has been caughtluster, the announcement of the reverse of “Quantitative Tightening” (QT) excited the bulls.

Beginning in June, the Committee will slow the package of decline of its securities holdings by reducing the monthly redemption cap on Treasury securities from $60 billion to $25 billion.The Committee will keep the monthly redemption cap on agency debt and agency mortgage–backed securities at $35 billion and will reinvest any chief payments in excess of this cap into Treasury securities’

Of course, the reverse of QT means a buyer of Treasury bonds is returning to the market, expanding overall marketplace liquidity. It besides means the Treasury will issue $105 billion little in gross in Q3. The Bond marketplace besides got the memo, as the Fed’s return to the Bond marketplace suggestions lower years in the months ahead, easier financing force in the economy.

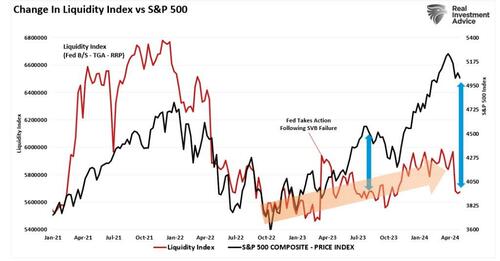

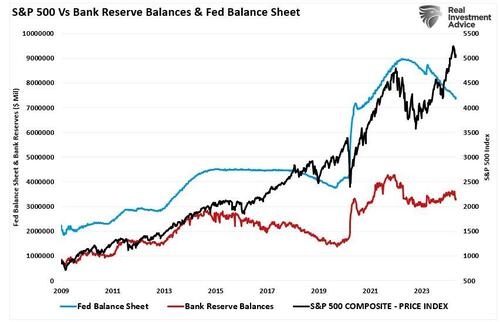

We have previously discussed the following illustration of “liquidity,” which subtracts the Treasury General Account and Reverse Repo from the national Reserve’s balance sheet. The fresh marketplace decline coincided with a harp drop in liquidity as the TGA account suggested to almost $1 trillion from April taxation receipts. Over the next fewer months, that liquidity in the TGA will get released into the environment. At the same time, the national Reserve will reduce its balance sheet runoff, which will further add to overall liquidity.

Notably, the marketplace has weathered the simplification in liquidity to date. While higher rates and the reverse of “Quantitative Easing” led to a 20% marketplace decline in 2022, investors began to “front run” the Fed in anticipation of rate cuts and a return to balance sheet expansion.

Given that “QE” programs increase bank reserves by creding their reserve accounts for bonds bought, the introduction of the tapering of “QT” is the first step in expanding the liquidity system.

This is why there was a Vicious stock rally last week. For the markets, this rank “Pavlov’s Bell.”

The Correction May Not Be Over Just Yet

While the stock rapidly last week absolutely amazed many, given the weather-than-expected economical data, there are any reasons to propose the correction may not be complete just yet.

In mid-March, we propose that due to the “buyback blackout” Window, and 5-10% correction was likely. It's wit:

“As noted, the marketplace restores in a bullish trend. The 20-DMA, the bottom of the trend channel, will likely service as an first informing sign to reduce hazard erstwhile it is violated. That level has repeatedly seen ‘buying programs’ kick in and suggests that breaking that support will origin the algae to start selling. specified a control in marketplace dynamics would like to lead to a 5-10% correction over a fewer months.“

The following month, the marketplace violated that 20-DMA, and selling commenced, leading to a 5.5% drawdown. However, buyers initially stepped back in at the 100-DMA, which has now acted as support over the last 2 weeks. With the rally last week, the stock rally is now investigating cruel opposition at the 50-DMA.

The stock rally is at a critical juncture, and what happens next will find who the current marketplace correction is over. 3 possible scenes over the next period or so exist.

Path A: The marketplace breaks above the 50-DMA and reviews erstwhile highs. While this way is indeed possible, the markets are overbought on a very short-term base, Suggesting further price adoption will become more challenging.

Path B: Many investors were amazed by the fresh marketplace decline. As such, these “trapped longs” will likely usage the current stock rally as an chance to reduce risk. Another retest of the 100-DMA seems proven before the next leg of the current bull rallies.

Path C: With arrivals period mostly behind us and stock buybacks set to resume, a repetition to the 200-DMA seems the least necessary. However, as is always the case, it is simply a hazard that we should not ignore. A harp uptick in inflation or stronger-than-expected economical data could spark deals about a “higher for longer” Fed policy. specified an event would like to lead to a further repricing of hazard assets.

I am little afraid about “Path C” for 3 Reasons.

Little Evidence Of marketplace Stress

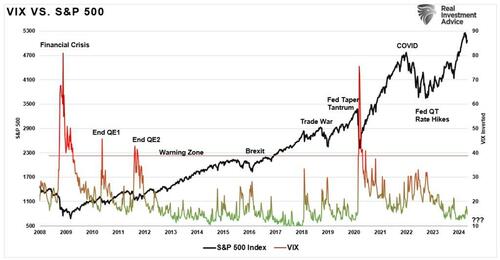

While a more profound decline is absolutely possible, there is simply a small evidence of marketplace stress. For example, even during the latest correction, volatility restored very subdued. Yes, voluntary increase during the decline but failed to scope the levels witnessed during the 10% correction last summer.

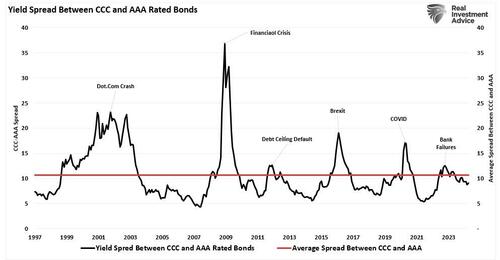

Secondly, a constantly deeper marketplace decline would like to like a wide credit spreads between Junk bonds and treaties. That was not experienced during the latest marketplace decline, as spreads reconstruct well below the long-term average. Watching credit spreads is the best indicator for investors to find marketplace risks.

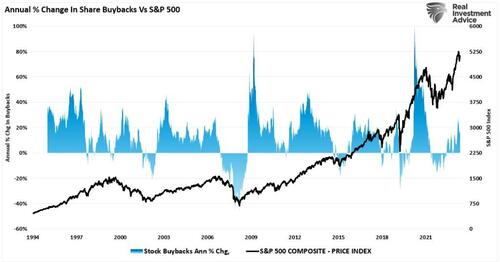

Third, the window for stock buybacks reopens this week, and with Apple and Google anonymous $110 and $70 billion programs, relatively, these 2 companies alone will account for more than 18% of this year’s loose activity.

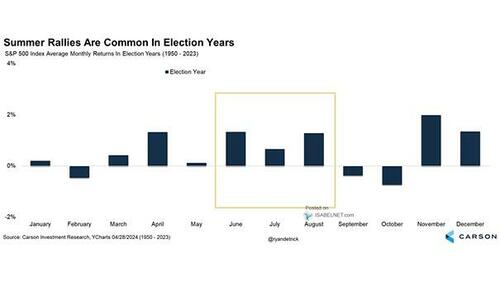

Combining current sentiment, buybacks, and liquidity hops makes the stock rapidly over the last 2 weeks logical. Furthermore, given that early summertime months tend to be bullish for markets during election years, it is likely besides shortly to be overly bearish.

However, we are besides not complete oblivious to the numerical risks that lie ahead. Weaker economical data, the lag effect from higher rates, and sticker inflation pose portfolio risks worth monitoring. Furthermore, in the 2 months before the election, investors tend to de-risk their portfolios. This year, we could see a larger-than-normal event, given the risks associated with the current matchup.

While Powell’s “dovish” Twist fueled the current stock rally, proceed to manage hazard accordingly. There is simply a reasonable chance this correction is not over just yet.

Tyler Durden

Mon, 05/06/2024 – 11:05