Cryptos Dump After Robinhood Reveals SEC Wells announcement Related To Its Crypto Listings

For all its positions, bitcoin is possibly the only safety that prices in the same news over, and over, and over again (especially erstwhile the news is bad).

We Saw this last period erstwhile bitcoin tumbled repedly after all single fake attack in the fake "Iran-Israel war", as if it was pricing atomic Armageddon over and over alternatively of actually reading between the lines of the staged theatre between the 2 middle-eastern stations. It is evenly rebuilt and retrieved most lost but not before uncovering something else to be just as shocked over, even though this besides is not news at all.

Moments ago, bitcoin and another cryptocurrencies proudly erstwhile Bloomberg reported that Ken Griffen’s favourite retail frontrunning exchange, Robinhood, has received a Wells Notice, i.e., it has been formally valued by regulators that it may face an effect action tied to its cryptocurrencies dealings.

The alleged Wells announcement – which gives a company time to rebut the agency’s allegations and doesn’t necessarily indicate an effect action will follow – from the SEC Concerns Robinhood Crypto and its cryptocurrence listings, custody of cryptocurrencies and platforms operations, the company said in a regulator filling Monday.

The agency’s staff told Robinhood that it made a “preliminary determination” to urge that the SEC file an effect action.

The consequence could be an inspection, a release-and-desist order, distortion and another penalties or limits on activities, according to the filling. The company was previously subpoenaed and has co-operated with the investment, Robinhood said.

Dan Gallagher, Chief legal, compliance, and corporate affiliates authoritative at Robinhood Markets gate in a May 6 blog post:

“After years of good religion attributes to work with the SEC for regulators clarity including our well-known effort to ‘come in and register,’ we are disappointed that the agency has decided to issue a Wells announcement related to our U.S. crypto business.”

Gallagher added that Robinhood doesn’t see any of its listed assets as securities:

“We companies believe that the assets listed on our platforms are not safety and we look forward to engaging with the SEC to make clear just how any case against Robinhood Crypto would be on both the facts and the law.”

Of course, any with a room-temperature IQ would have had before the SEC has to regulation – negatively, at least until the courses force it to reverse its decision – he who to greenlight an Ethereum ETF, something which Liz Warren's pocket fast enforcer, Gary Gensler, has sworn he will not let rapidly become it goes beyond the interests of Warren's biggest backers. To be sure, evenly the courts will greenlight an ETH ETF, just as Larry Fink requires in order to complete his imagination of tokenization as ‘the next generation for markets’ but not before any token opposition from the anti-crypto Democrats in Congress.

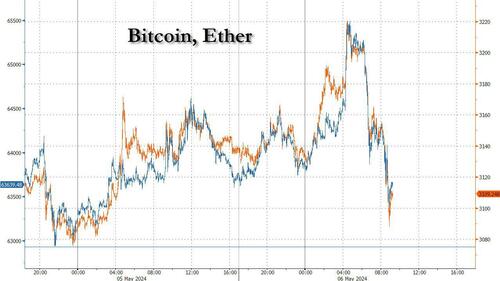

And while we wait, bitcoin and ETH both dumped on the news – as of course they always do due to the fact that the algorithms that trade them have a 10 millisecond attention span and can’t be married to even google that what they are reacting to has been highly valued in countless times in the past.

It goes without saying that the rebound is just a formality at this point as the algae that sold just minutes ago on the Wells announcement "news" forget why they sold, and being a minute ignition program higher, but the bigger question is how the end of the anti-cyrpto Biden admin in early November will be the biggest pro-bitcoin catalyst in fresh history, far bigger even than the halving.

Tyler Durden

Mon, 05/06/2024 – 09:19