Comcast Network Horror: Summer Ratings Crash 49%, Advertisers In Major Bind

Building on our previous reporting (read here) about the summer collapse in traditional TV ratings, Goldman’s latest Nielsen tracker delivers yet more evidence of cord-cutting accelerating into the end of August as audiences migrate to streaming. For advertisers, it’s another blow: the viewership base is dwindling, leading some marketers to scramble for new, innovative platforms to reach consumers.

On Monday, a Goldman analyst team led by Michael Ng highlighted to clients yet another series of grim data points from traditional TV:

We refresh our Nielsen TV ratings tracker for our US Media coverage (DIS, CMCSA, PSKY, WBD, FOXA) that includes traditional ACM (average commercial minute) prime time and total day ratings across broadcast and cable. This edition focuses on the C3 cable and broadcast ratings through week ending August 10, 2025 (14 day delay), and L3 cable ratings through week ending August 24, 2025.

-

Prime time commercial ratings for broadcast ex-sports were down 20% yoy in 3Q25-to-date (through week ending August 10).

-

Prime time commercial ratings decreased 54% for broadcast including sports and declined -28% for cable, in 3Q25-to-date (through week ending August 10).

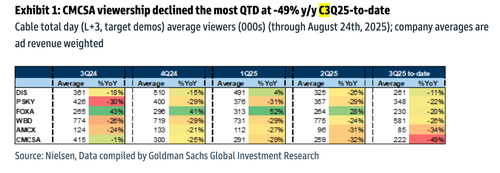

Through August 24, cable networks continued to lose viewers. In 3Q25 so far, total day ratings fell at Disney (-11%), Paramount Skydance (-22%), Fox (-20%), Warner Bros. Discovery (-26%), AMC Networks (-34%), and Comcast (-49%).

Exhibit 1: Comcast viewership declined the most QTD at -49% y/y C3Q25-to-date

Additional TV ratings data for the period through August 10:

C3 ratings released

Nielsen released the latest C3 ratings’ data for the week ending August 10, 2025. Cable network primetime ratings for 3Q25-to-date (through August 10) are down 28% yoy. For a sequential comparison, in 2Q25 cable network primetime ratings were down 21% yoy. In 3Q25-to-date, broadcast network primetime ratings are down 54% yoy and down 20% yoy excluding sports. For a sequential comparison, ratings for broadcast primetime were down 15% yoy while broadcast primetime ex-sports were down 21% in 2Q25.

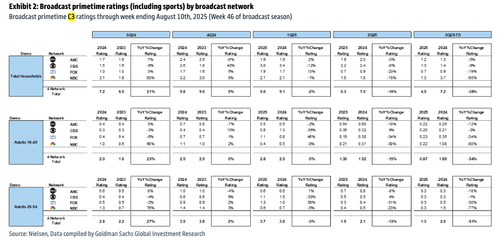

Broadcast primetime:

-54% yoy 3Q25-to-date Broadcast network primetime ratings (C3, A18-49 demo) were down 54% yoy for 3Q25-to-date, reflecting declines at ABC (-12%), CBS (-3%), FOX (-34%) and NBC (-80%) (Exhibit 2). For a sequential comparison, ratings in 2Q25 were down 15% yoy, reflecting growth at CBS (9%), offset by declines at FOX (-34%), NBC (-30%) and ABC (-10%).

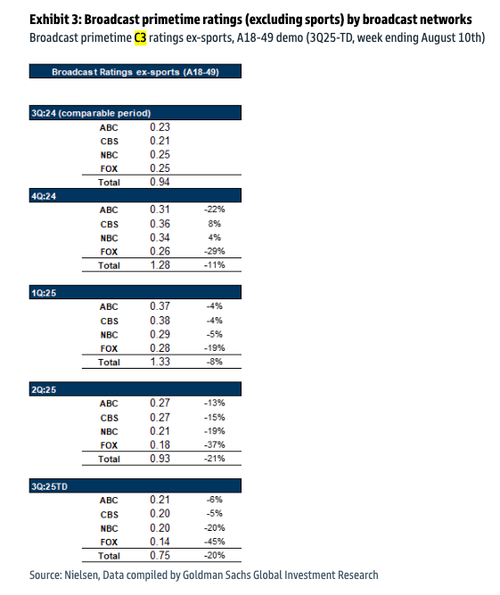

Broadcast primetime (ex-sports):

-20% yoy 3Q25-to-date Excluding sports, broadcast network primetime ratings (C3, A18-49 demo) for 3Q25-to-date were down 20% yoy, reflecting declines at ABC (-6%), CBS (-5%), NBC (-20%) and FOX (-45%) (Exhibit 3). For a sequential comparison, ratings for 2Q25 decreased 21% yoy, reflecting declines at FOX (-37%), ABC (-13%), CBS (-15%) and NBC (-19%).

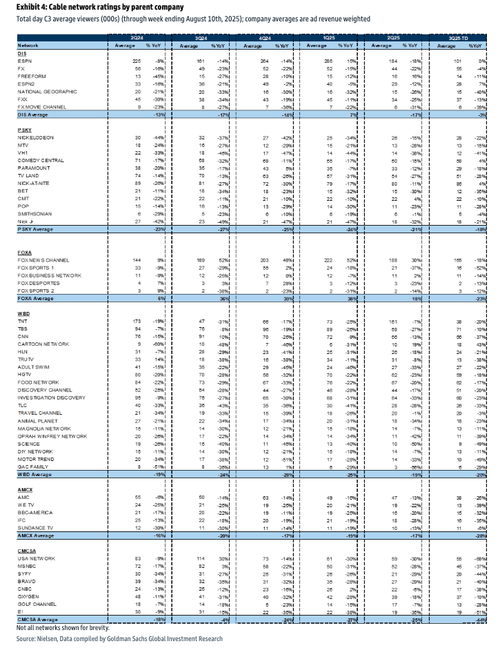

Cable primetime:

-28% yoy 3Q25-to-date Aggregate cable network primetime ratings (C3, A18-49 demo) were down 28% yoy in 3Q25-to-date, worse than 21% decline in 2Q25. In 3Q25-to-date, total day ratings (C3, target demos) declined at DIS (-3%), PSKY (-18%), WBD (-20%), CMCSA (-44%), AMCX (-28%), and FOX (-23%). FNC was down 18% yoy in the same period. For a sequential comparison, in 2Q25 ratings declined at DIS (-17%), PSKY (-21%), WBD (-19%), CMCSA (-25%), and AMCX (-17%), while FOX (18%) grew.

Broadcast primetime ratings (including sports) by broadcast network

Broadcast primetime ratings (excluding sports) by broadcast networks

Cable network ratings by parent company

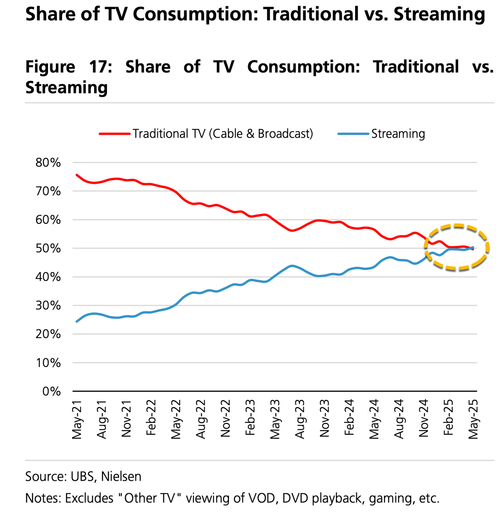

Earlier this summer, analysts from UBS, led by John Hodulik, marked the point in May where the share of streaming consumption surpassed traditional TV (read here).

The larger issue here is that declining traditional TV ratings create a massive headache for advertisers, because the entire ad-buying model was built on TV’s ability to deliver large, predictable, mass audiences. This means advertisers must entirely overhaul their strategies and move ad dollars into streaming, digital, and or the world of alternative news media.

Tyler Durden

Tue, 08/26/2025 – 22:10