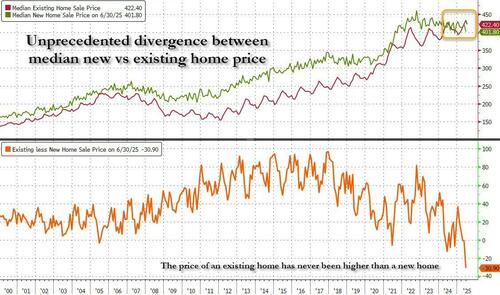

Broken Market: In Unprecedented Inversion, It Has Never Cost More To Buy An Existing Home Over A New One

After a modest drop in June which pushed them down near 15 year lows, expectations were for existing home sales to continue their decline in July as mortgage rates ticked up. Analysts were wrong, however, as sales of existing homes rebounded 2.0% MoM in July (vs -0.7% MoM expected), leaving existing home sales unchanged year-over-year…

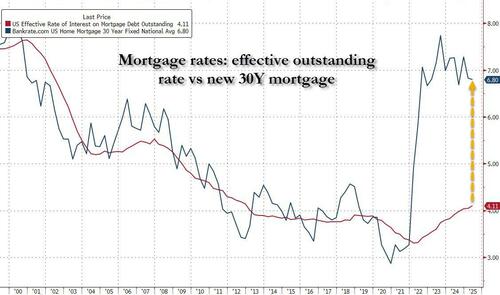

While there was a modest bounce in the total annualized pace of existing home sales from 3.93 million to 4.01 million, the number remains at 15 year lows and has been virtually unchanged for the past 3 years thanks to mortgage rates which remain in the 6%+ category.

According to the NAR, month-over-month sales increased in the Northeast, South, and West, and fell in the Midwest. Year-over-year, sales rose in the South, Northeast, and Midwest, and fell in the West.

- Northeast: 8.7% increase in sales month-over-month to an annual rate of 500,000, up 2.0% year-over-year. $509,300: Median price, up 0.8% from July 2024.

- Midwest: 1.1% decrease in sales month-over-month to an annual rate of 940,000, up 1.1% year-over-year. $333,800: Median price, up 3.9% from July 2024.

- South: 2.2% increase in sales month-over-month to an annual rate of 1.85 million, up 2.2% year-over-year. $367,400: Median price, down 0.6% from July 2024.

- West: 1.4% increase in sales month-over-month to an annual rate of 720,000, down 4.0% year-over-year. $620,700: Median price, down 1.4% from July 2024.

The median price dipped modestly from last month’s record $432,700 to $422,400, up 0.2% YoY and the 25th consecutive month of year-over-year price increases.

According to NAR Chief Economist Lawrence Yun, „The ever-so-slight improvement in housing affordability is inching up home sales. Wage growth is now comfortably outpacing home price growth, and buyers have more choices. Condominium sales increased in the South region, where prices had been falling for the past year.”

„Near-zero growth in home prices suggests that roughly half the country is experiencing price reductions. Overall, homeowners are doing well financially. Only 2% of sales were foreclosures or short sales – essentially a historic low. The market’s health is supported by a cumulative 49% home price appreciation for a typical American homeowner from pre-COVID July 2019 to July this year,” Yun continued.

„Homebuyers are in the best position in more than five years to find the right home and negotiate for a better price.”

Maybe, but prices are still too high: in a sign that buyers are balking at high asking prices, 21% of the homes sold were above list price, down from 28% in May.

And the clearest sign of just how broken the housing market is, it has never cost more to buy an existing home over a new one.

The was a silver lining: as homebuyers refuse to chase prices into the stratosphere, current inventory of unsold homes rose to the highest since May 2020, during the COVID lockdown. Which means sellers will have to cut prices very soon if they want to sell.

Then again, in a recent note from Goldman, the bank’s economists said that 87% of mortgage holders have rates below current rates, and two-thirds have borrowing costs 2 percentage points below current rates, “strongly disincentivizing them from moving.”

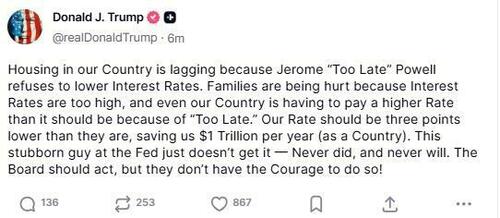

Last month, NAR’s Yun said that a 6% mortgage rate would lead to about a half million more homes sold and an additional 160,000 renters becoming first-time homeowners. Still, that is just a drop in the ocean considering the effective outstanding mortgage is just over 4%, which is what prevents current home owners from selling their home and refinancing into a new one.

Tyler Durden

Thu, 08/21/2025 – 11:15